KRN Shareholders

April 30, 2022 - Toronto Star Article - This Canadian mining company is sitting on billions worth of potash. Inside the battle that has angry shareholders alleging vote rigging and stock sabotage

The Toronto Star has published an article about this mess.

We ask all who click here to sign up for their fees to see the full article. It is well written and worth the wait.

PS. Some people on the BullBoards are already slamming the article. Remember they are all accountants who make up all of Karnalyte Resources Staff, board and posters on the Bullboards. Accountants do not know how to run mining companies, they know how to count.

April 30/22.

ALSO, SEE TORONTO STAR ARTICLE Link above

Leaked Pre-AGM Voting Tallies

Resulted in Votes Changed to

ensure KRN Board re-election in 2018......

To KRN Shareholders and whomever else it may concern:

Leaked 2018 KRN AGM voting information has been revealed to the

KRNShareholders.com website. It shows how numerous votes were

changed by AST/ D.F.King (now TSX TRUST) with the re-use of the

control number after shareholders voted - from WITHHOLD ALL to

ABSTAIN*. ABSTAIN was not even an option on your ballot. * Abstain =

not counted.

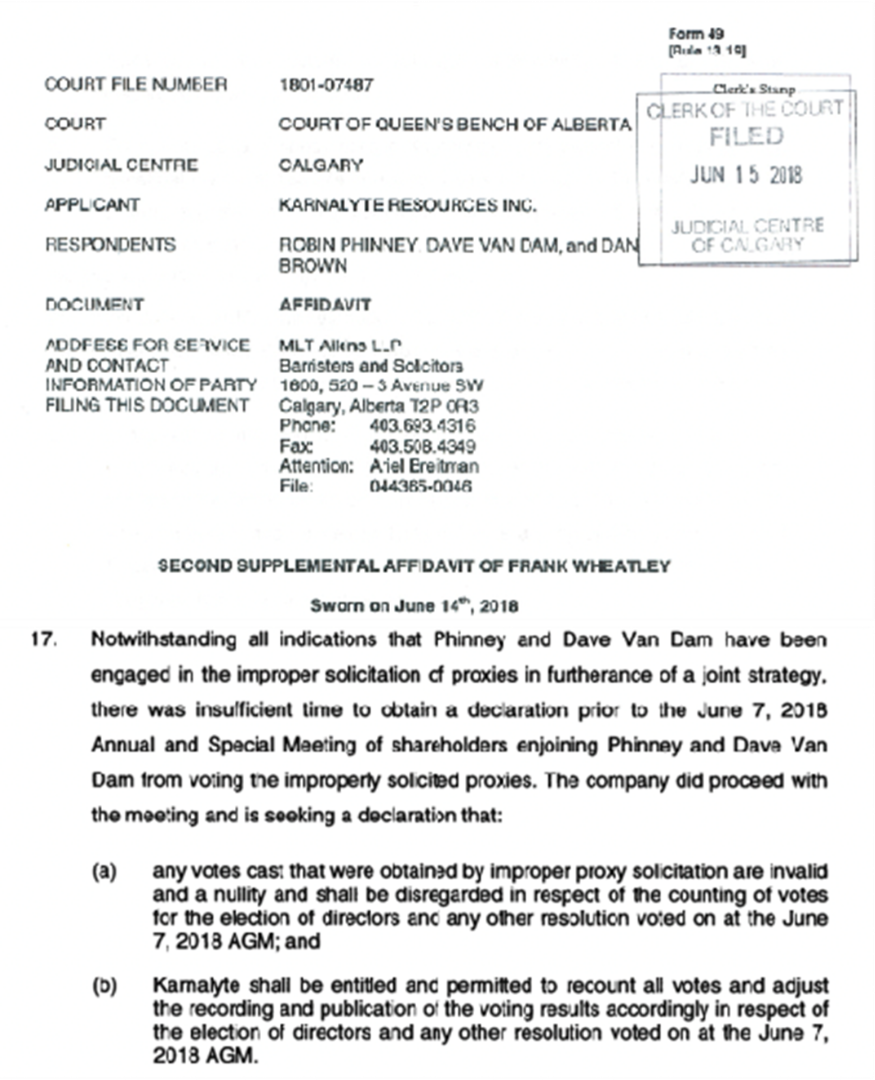

The information taken from the KARNALYTE RESOURCES Inc. website, (in

red ink below) clearly shows how D.F. King was paid a bonus to

ensure that enough votes were manipulated to re-elect the existing

board. It appears that someone at the head of Karnalyte ordered

multiple vote manipulations to ensure their re-election, using

shareholders’ money.

History of KRN 2018 Election

Vote Manipulation Strategy:

2018 - Jan - April - KRN board rejected nominations of 6 extremely

qualifed shareholders seeking board seats in order to ensure

re-election of the existing board. [Court described this suppression

as corporate terrorism

LINKS: [2020 ABQB 119]. [2021 ABQB 26]

2018- May 28 - KRN board initiated court actions against shareholders Robin Phinney, Dave Van Dam and Dan Brown claiming defamation of board on Stockhouse Bullboard and illegal proxy solicitation. Phinney, Brown and Van Dam were cleared of these charges by the court [2020ABQB 119 Page 25 VII Conclusion]

2018 - May - KRN board gained access to voting numbers to date and

realized that they didn’t have enough votes to win an “uncontested”

election (50% +1 vote

required)

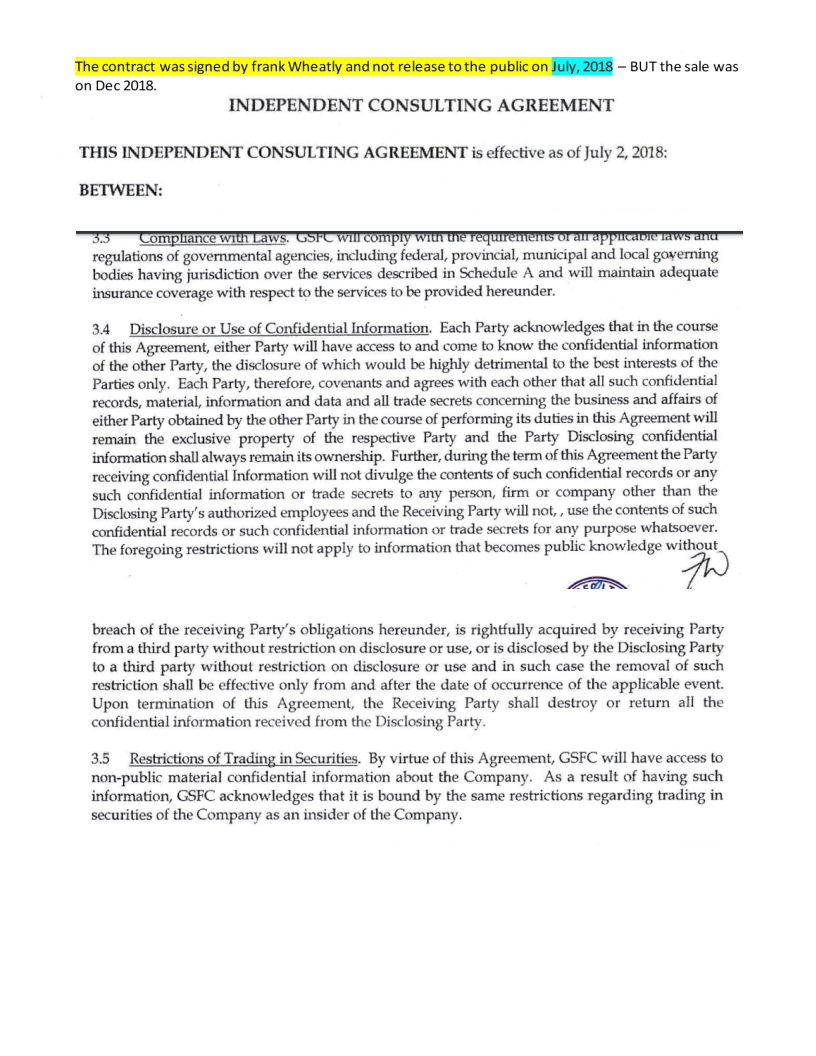

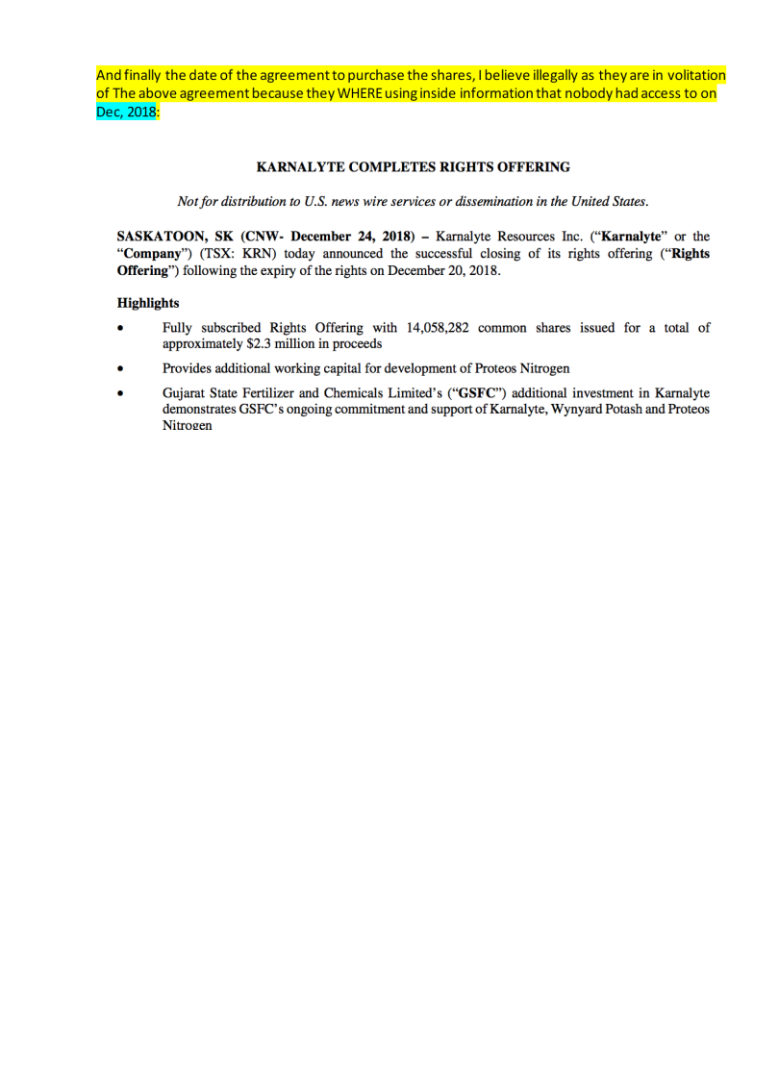

2018 May 29 - KRN engaged D.F. King, a subsidiary of AST (now TSX

TRUST) to “ensure” an election win, posting this action on their

website:

“ABOUT D.F. KING:

The Company has engaged the services of D.F. King, a division of AST

Investor Services Inc. (Canada), as its proxy solicitation

and information agent. Engaging a proxy solicitor is very common for

publicly traded

– companies as it helps facilitate shareholder engagement in the

governance of the company. Initiating a targeted shareholder

engagement effort supports shareholder democracy by ensuring that

all shareholders, despite the size of their holdings, receive

timely, current, and comprehensive

information about the Company and the matters to be voted on at its

shareholder meetings. D.F. King has been engaged at an anticipated cost of $125,000 consisting of a base fee of $50,000 and an additional fee of $35,000, if management’s nominees are elected and each of the resolutions recommended by management is passed, and a further

$40,000, based on the number of votes cast in favour of, or withheld from voting for, each of management’s nominees. The total potential cost will be borne by the Company. “

- From the May 29, 2018 Press Release, Karnalyte Resources

Website

2018 May 29 - Jun 7 - On instructions from KRN, D.F.King issued a

second

election yer 4 1/2 days prior to the AGM, targeting major

shareholders only With full access to voter response to date, KRN

Board could see that they had

approximately 7.4 million votes in their favour with the potential

of 10.5 million

votes against them. On instructions from KRN Board representative,

D.F. King

started changing voter positions from WITHHOLD to ABSTAIN in order

to swing

the vote to the favour of the existing board. D.F. King failed to

check the names

of the shareholders for whom they were manipulating votes. MANY of

the victims

were members of the founder Robin Phinney’s family and close

friends. They

voted to WITHHOLD, not Abstain. The vote records supplied by Mr

Frank

Wheatley Exhibit #2 clearly show the original votes cast. CIBC

records, however,

show a number of those family members as having Abstained. Copies of

their

Voting Control sheets prove otherwise.

C ross referencing the names of those who were later reported as

appointing

management as proxy designate, provides further evidence of vote

tampering.

***** Proof of pre-election vote proxy monitoring:

(Leaked to krnshareholders.com Jan 14/22 )

“Confidential

From: **************

Sent: Tuesday, September 25, 2018 10:18 AM

6. On May 29, Robin Phinney was granted proxies for 1,954,599 shares;

7. On May 30, Robin Phinney was granted proxies for 209,842 shares;

8. On May 31, Robin Phinney was granted proxies for 1,127,227 shares;

9. On June 1, Robin Phinney was granted proxies for 69,029 shares;

10. On June 4, Robin Phinney was granted proxies for 29,818 shares;

11. On June 5, Robin Phinney was granted proxies for 552,662 shares

[Total = 3,943,177];”

According to F Wheatley affidavit, the company took it upon itself to disqualify over 4 million votes during the election which the above email clearly states had been authorized by the ASC to be counted]:

.

(April 30/22 - Further recent court testimony revealing vote

manipulation to follow............)

Knowing that AST/D.F. King and KRN Management changed the votes in the KRN election of officers in 2018...........

We have proof that the proxy voting system at AST/ TSX TRUST is not secure.

We know first hand that our securities regulators are not protecting shareholders.

We know that the major banking institutions are not protecting their investment clients.

We know that foreign take-over of a prime Canadian natural resource is being permitted to happen with no investigation at any level, so.........

....The Multi-million Dollar Question is:

How many other companies in Canada have had their voting results intentionally manipulated too?

Who can we trust? Who is blocking this investigation? Is this bigger than WorldCom Scandal?

Thanks again for your efforts to help our company realize its full potential.

Stan Phinney, Shareholder.

(Also see www.krnshareholders.com)

------ Original

Message ------

From: [email protected]

To: [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]

Sent: Thursday, January 27, 2022 10:26 AM

Subject: Fwd: voter fraud

STILL WAITING FOR ANSWER

APPARENTLY YOU DON'T LISTEN TO THE COURTS ALSO

WOW, WOW, WOW

WWW.KRNSHAREHOLDERS.COM

Via Courier

Alberta Securities Commission

Suite 600, 250-5th St. SW Calgary, Alberta, T2P OR4

Dear Sirs/Mesdames:

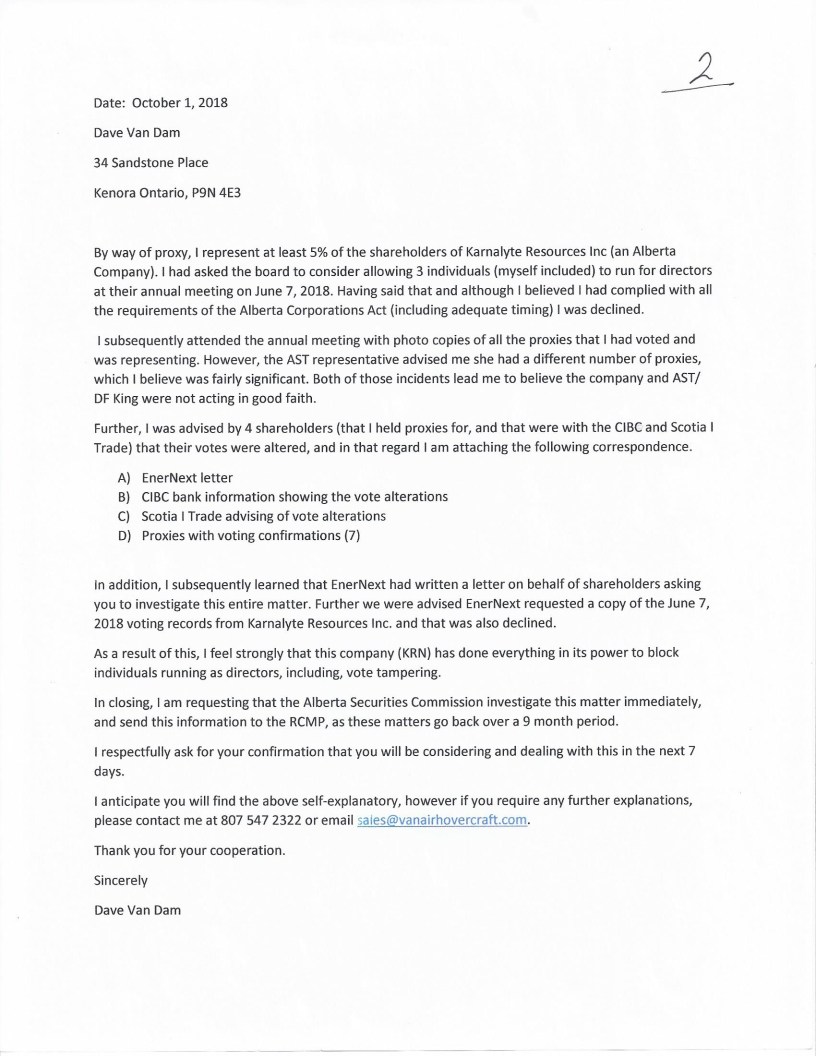

Voting Irregularities at Annual General and Special Meeting of Karnalyte Resources Inc. held on June 7, 2018 in Saskatoon, Saskatchewan

We are local counsel to Robin Phinney, an individual resident in the Town of Okotoks, in the Province of Alberta ("PhinneV') in connection with the solicitation of proxies in connection with an annual general and special meeting of the shareholders of Karnalyte Resources Inc. ("Karnalyte"), which occurred on June 7, 2018 (the "Meeting") in Saskatoon, Saskatchewan.

We are writing in order to draw your attention to certain voting irregularities that we witnessed at the Meeting. We are concerned with both the number of shares that voted at the Meeting in favour of management's proposed items of business, as well as a number of votes for dissident shareholders which appear not to have been counted. We are also concerned with the conduct of management of Karnaltye and their attempts to intimidate possible dissident shareholders.

We are writing in order to draw your attention to certain voting irregularities that we witnessed at the Meeting. We are concerned with both the number of shares that voted at the Meeting in favour of management's proposed items of business, as well as a number of votes for dissident shareholders which appear not to have been counted. We are also concerned with the conduct of management of Karnaltye and their attempts to intimidate possible dissident shareholders.

Firstly, voter turnout has historically been relatively high for annual meetings of Karnalyte, falling between 12.17 million and 16.04 million shares voted since 2014, with an average of 14.42 million shares during the years 2014 to 2017 inclusive, representing slightly more than half of the shareholders of Karnalyte. However, the number of shares voted at the Meeting were an unusually large aberration from historical norms. At the Meeting, the shares voted were 18.25 million, representing almost 2/3 of the shares of Karnalyte and an increase of almost 4 million shares voted as compared to the historical average, or close to a 30% increase from the historical average. This was especially surprising given that many of the shareholders that Phinney spoke with had not received their proxy materials prior to the Meeting and the mailing of the Meeting materials appears to not have happened until the 21st day prior to the Meeting (based on the certificate of dissemination filed on SEDAR by the transfer agent for Karnalyte), being the very last day when materials could have been sent out in compliance with applicable securities laws, allowing for the minimum amount of time possible for shareholders to receive their proxy materials and vote their shares.

In addition to this, Phinney had been in contact with various individuals regarding voting their shares against the matters put forth by management and was also independently contacted by various shareholders that he knew personally and who provided him with evidence that they had voted their shares against management's proposed items of business. When Phinney attended the Meeting and asked the scrutineer for the numbers represented by these shareholders, the numbers provided to him did not match those that he was expecting based on the evidence presented to him ahead of the Meeting. The shares represented by dissident shareholders that Phinney knew or had been in contact with appear not to have been counted in many instances. In addition, most or all of the additional shares that voted

T

at the Meeting appear to have voted in favour of management's proposals. It is also noteworthy that management hired a proxy solicitation firm, D.F. King, despite the fact that there was no active proxy battle and that Phinney did not even obtain an order from the Alberta Securities Commission to solicit proxies until less than a week prior to the Meeting. It is noteworthy that D.F. King is a company affiliated with AST Trust Company, Karnalyte's transfer agent, and therefore had access to the control numbers on shareholders proxies and was also able to reach out to shareholders who had previously voted and try to convince them to change their vote.

Lastly, management created an environment at the Meeting meant to stifle active discussion and debate and intimidate possible dissidents. Management hired a total of four (4) uniformed Saskatoon police officers who were present in the room during the Meeting and all of whom were carrying sidearms. Management could have easily hired a private security company if it had concerns about security at the Meeting, but instead chose to hire armed police officers in full uniform, which created a chilling effect on possible discussion and debate by the dissident shareholders about their concerns with how the company was being run and the actions of the management team. We can provide photographic and video evidence of the environment at the Meeting upon request.

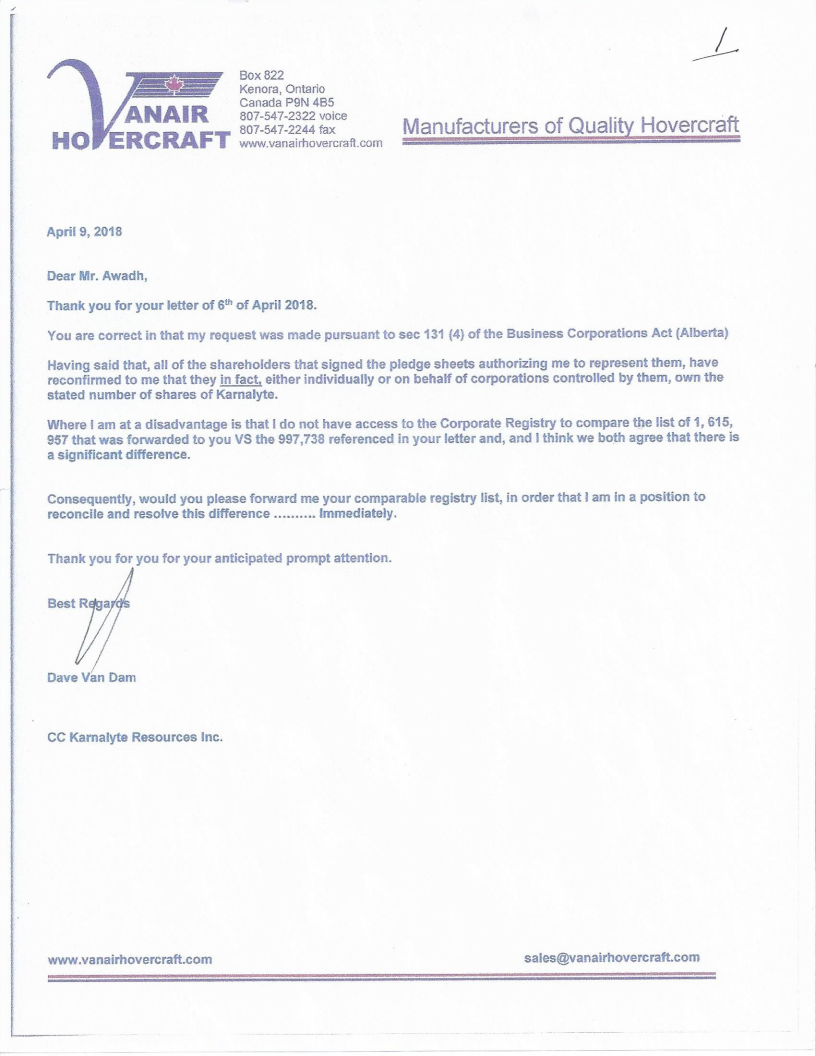

It is also worth noting that my client, as well as another shareholder, David Van Dam, an individual resident in the Town of Kenora, in the Province of Ontario, both proposed certain nominees to be elected at the Meeting as far back as January, 2018, such nominees to be put forth as a shareholder proposal, and were rebuffed by management of Karnalyte as well as their counsel in such attempts. Often, management and their counsel would take a considerable amount of time to respond to these proposals and come up with various administrative or procedural reasons to refuse to include these proposals in any future annual meeting of shareholders of Karnalyte. These appear to be clear attempts to cause the proposals to fall outside of the applicable time limits for same and provide further reasons to deny the proposals being considered by the shareholders at an annual meeting of shareholders. As such, the actions of management and the board of directors of Karnalyte have been part of an orchestrated effort to entrench themselves and refuse to give the shareholders of Karnalyte the opportunity to have input on anything other than the status quo.

We would ask that the Alberta Securities Commission conduct an investigation into these allegations of voting irregularities and also be prepared to oversee any possible special shareholders meeting which may be requisitioned by Phinney in the near future.

T

T

If you have any questions or concerns in respect of the foregoing, please do not hesitate to contact the undersigned. Thank you.

Yours truly,

EnerNEXT Counsel

Peter W. Yates (403) 971-9104 [email protected]

------ Original

Message ------

From: [email protected]

To: [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]

Sent: Tuesday, January 25, 2022 11:04 AM

Subject: Fwd: Fwd: Court case krn

BETTER READ THIS AGAIN.

WERE IS MY ANSWER

WWW.KRNSHAREHOLDERS.COM

------ Original Message ------

From: [email protected]

---------- Original Message ----------

Date: January 11, 2021 at 3:32 PM

Subject: Court case krn

Court of Queen's Bench of Alberta Citation: Karnalyte Resources Inc

v Phinney, 2021 ABQB 26

FILED JAN 11 2021

Date: Docket: 1801 07487 Registry: Calgary

Plaintiff / Applicant

Between:

KARNALYTE RESOURCES INC

- and -

ROBIN PHINNEY, DAVE VAN DAN and DAN BROWN

Defendant / Respondents

_______________________________________________________

Costs Decision

of the

Honorable Madam Justice BE Romaine _______________________________________________________

I. Introduction

[1] This decision addresses the issue of costs sought by two of the Respondents in the within action. My reasons for judgment are dated February 14, 2020 and can be found at 2020 ABQB 119.

[2] The Respondent Robin Phinney seeks costs on a “solicitor-client” basis, or alternatively on a scale that is a multiple of Schedule C costs as set out in the Rules of Court. Mr. Phinney was entirely successful in defending against the application brought by the applicant Karnalyte Resources Inc. He seeks solicitor-client costs on the basis that the conduct of Karnalyte,

Page: 2

including as described in my reasons, brings the fundamental issue of fairness and efficiency that

underlie the Rules squarely into play and justifies an award of solicitor client costs.

[3] Karnalyte opposes such an award of costs, submitting that the appropriate quantum of costs should be calculated on the basis of column 3, with appeal costs awarded for item 20(1) in accordance with item 8(1) of Schedule C.

[4] For the reasons that follow, I award Mr. Phinney solicitor-client costs inclusive of disbursements of $213, 513.19.

[5] The Respondent Dan Brown also seeks costs on a solicitor-client basis for many of the same reasons. Mr. Brown submits that Karnalyte’s motivation has been to weaponize this and other litigation against the Respondents in order to cause the Respondents as much expense and hardship as possible, both professionally and financially.

[6] Mr. Brown was substantially successful in the litigation, other than my finding that one posting he made on an internet chatroom on the day the application was filed constituted an unlawful solicitation of proxies. I found that Karnalyte had suffered no damages from this solicitation, and given Mr. Brown’s subsequent conduct, no remedy need be imposed against him.

[7] Karnalyte submits that Mr. Brown is not entitled to costs as he is an unsuccessful party, that each party should bear their own costs, or in the alternate, that Mr. Brown is only entitled to costs in accordance with Schedule C, column 1. Karnalyte also seeks costs for its written submissions on costs.

[8] For the reasons that follow, I award Mr. Brown solicitor-client costs of $49,649.50 inclusive of disbursements and other charges and dismiss Karnalyte’s application for costs of the costs submissions.

II. Mr. Phinney’s Application

[9] As Mr. Phinney was entirely successful, he is entitled to costs. The only issues are whether he is entitled to solicitor-client costs, and if so, in what amount.

[10] Mr. Phinney agrees with Mr. Brown that the litigation was conducted as a “weapon” in order to ensure that Mr. Phinney (and the other Respondents) were put to as much expense and hardship as possible, in a situation where the allegations against them were serious, as well as personally and professionally damaging.

[11] Karnalyte makes much of the fact that the application was not complex and was heard in a half day. However, this fails to indicate the history of the application and the voluminous briefs and materials that were filed by the parties in advance of oral argument.

[12] As noted by Mr. Phinney, the steps taken to move this matter from filing to hearing involved the following:

(a) Two Originating Applications (the second being an Amended Originating Application).

Each application was about 20 pages in length and included significant allegations of wrongdoing, including allegations that Mr. Phinney attempted to obtain a personal gain because of his prior position as CEO

Page: 3

of Karnalyte. I agree with Mr. Phinney that Karnalyte essentially alleged fraud against Mr. Phinney without using that term. The Amended Originating Application asserted that, during his tenure as Karnalyte’s President and Director, Mr. Phinney attempted to extract significant personal benefits as part of a proposed financing transaction between Karnalyte and its strategic partner and largest shareholder. Karnalyte states in the application that this attempt was ultimately rejected by the shareholder, and partially formed one of the grounds for Karnalyte’s just cause to terminate Mr. Phinney’s employment as President.

The application also asserts that Mr. Phinney’s shareholder proposal of March 27, 2018 was a clear attempt to redress past grievances, specifically Mr. Phinney’s termination as Karnalyte’s President, his failure to be re- elected as a Director, and his failure to obtain significant personal benefits as part of the proposed transactions between Karnalyte and its strategic partner and shareholder.

These allegations of significant wrongdoing by Mr. Phinney were unnecessary in terms of the issues in the application. They did not need to be addressed in the reasons for decision, and were not proved by the evidence before me.

(b) Four affidavits sworn by representatives of Karnalyte which were many hundreds of pages in length.

(c) Two affidavits filed by Mr. Phinney. Mr. Brown filed one affidavit and the Respondent Dave Van Dam filed two affidavits.

(d) Two full days of questioning on Mr. Phinney’s affidavits (and several more days as the other Respondents were questioned on their affidavits).

(e) Questioning of three non-parties by Karnalyte without prior notice to Mr. Phinney. Karnalyte did not provide Mr. Phinney with the transcripts of two of the questionings, nor did Karnalyte include these or the questioning transcript of Stan Phinney in the record it put before the Court although the transcript was later produced and referred to in the decision.

(f) An application filed by Karnalyte to gain access to unredacted versions of Mr. Brown’s telephone records, which was dismissed with costs to Mr. Brown.

(g) A contested adjournment application wherein Mr. Phinney and the other Respondents were successful in obtaining an adjournment and costs in the cause.

(h) A Norwich application brought by Karnalyte in British Columbia without notice to Mr. Phinney and without disclosure of any materials contained therein to him despite requests that this information be provided.

(i) A special application scheduled for a full day with lengthy briefs. In support of the application, a four-volume record was filed with the Court

Page: 4

totalling 4100 pages. Despite this, additional material was filed before and during the hearing.

[13] In addition to the complexity of the application as a reason for enhanced costs, Mr. Phinney submits that Karnalyte engaged in misconduct in the litigation, including the following:

(a) failure to advise Mr. Phinney that non-parties had been questioned, and delay in providing information about the questioning;

(b) obtaining an order without notice from the Supreme Court of British Columbia against the internet website that hosts the chatroom in order to learn the identity of “theend6543”, which Karnalyte had asserted in its application was Mr. Phinney’s alias. No party to the application received information with respect to the result of the Norwich order, which did not yield evidence that “theend6543” was Mr. Phinney or any of the other Respondents. Karnalyte refused a “with prejudice” request to disclose the material accompanying the application against the internet website and any resulting production;

(c) filing a late affidavit with the brief for the application, thus depriving Mr. Phinney of the right to cross-examine or respond;

(d) mischaracterizing the questioning evidence in its brief, as noted in the reasons for decision, not less than five times;

(e) misstating the number of telephone conversations between Mr. Phinney and Mr. Brown in its brief; and

(f) advising the Alberta Securities Commission that it would not be challenging the exemption order that had been granted to Mr. Phinney after the ASC objected on the basis of jurisdiction, and then, in its submissions, doing in effect exactly that, as I noted in the reasons for decision.

[14] The parties agree that the law in Alberta relating to the awarding of solicitor-client fees is aptly set out in Secure 2013 Group Inc. v Tiger Calcium, 2018 ABCA 110 at para 15:

Solicitor-client costs are generally awarded only when there has been reprehensible, scandalous or outrageous conduct by a party ... They are only awarded in rare and exceptional circumstances and may be available if misconduct occurs in the course of litigation ... A careful analysis of the facts is required...

[15] The Court in Tiger Calcium set out factors to be considered by a court at para 15, including the following relevant to this case:

a. blameworthiness in the conduct of the litigation;

Page: 5

b. when justice can only be done by a complete indemnification for costs;

c. where there was evidence that the appellant hindered, delayed or confused the litigation;

d. where there has been an attempt to conceal material documents and failure to produce material documents in a timely fashion;

e. positive misconduct, where others should be deterred from like conduct and the party should be penalized beyond the ordinary order for costs; or

f. untrue or scandalous charges.

[16] The Rules of Court also recognize as factors to be considered in determining an award of costs conduct that unnecessarily lengthens or delays the action or any of its steps, whether a party has engaged in misconduct, and any offer of settlement made, regardless of whether or not the offer for settlement complies with Part 4, Division 5: Rule 10.33(1) and (2).

[17] Relevant to the latter, counsel for Mr. Phinney, in a “with prejudice as to costs” letter dated March 29, 2019, correctly pointed out that Karnalyte’s pending 2019 Annual General Meeting rendered the outcome of the application moot. Karnalyte disregarded this letter.

[18] Given all these circumstances and factors, I find that this is one of the cases where justice can only be done by a complete indemnification of costs. Mr. Phinney’s claim for solicitor-client costs totals $213,513.19 inclusive of fees, disbursements and GST.

[19] Karnalyte submits that this amount is too high, and proposes a lower amount. It is noteworthy that Karnalyte’s 2018 “Management Discussion and Analysis” published on the SEDAR website discloses the following under the heading “Accounting and Legal”:

... expenses for the year ended December 31, 2018, ... [saw] an increase of $841,000 ... the legal expenses were principally incurred ... with respect to the filing by the Company of an originating application with the Alberta Court of Queen’s Bench seeking declarations from the court that the Respondents acted jointly and in concert to conduct various activities, including an illegal proxy solicitation, in connection with the 2018 AGM in contravention of the provisions of the Canadian corporate and securities laws, and that those proxies should therefore be disallowed. (emphasis added)

[20] Karnalyte’s submission that Mr. Phinney’s fees are unreasonable is untenable in the circumstances, particularly given that its own fees and disbursements appear to be considerably higher. Its complaint about the size of Mr. Phinney’s legal team is also not justified. I accept Mr. Phinney’s evidence that, between June 7, 2008 and May 5, 2020, he was represented first by Southern Alberta Law Offices, then Enernext Counsel and finally Borden Ladner Gervais LLP. Mr. Phinney was defending himself against serious allegations relating to his personal and professional ethics and entitled to counsel appropriate to the escalating litigation. I therefore award Mr. Phinney costs in the amount of $213,513.19.

[21] Given my decision, it is not necessary to consider the alternatives suggested by either Mr. Phinney or Karnalyte.

Page: 6

III. Mr. Brown’s Application

[22] Mr. Brown relies on many of the same factors that I have found justify an award of indemnification costs to Mr. Phinney. He also notes the following relevant factors:

(a) It is apparent from the evidence that Mr. Brown made repeated attempts to resolve issues with Karnalyte without resort to litigation. Months prior to the application, his counsel provided Karnalyte with redacted copies of Mr. Brown’s cell phone and home phone records for the material time period between May 1, 2018 and June 7, 2018, and a thorough explanation of any communications between Mr. Brown and Mr. Phinney on a without prejudice basis.

Karnalyte applied for unredacted copies of the records, and was unsuccessful in that application, with costs levied against it payable “forthwith”. Despite repeated requests, Karnalyte has not paid the cost award.

(b) The single posting that I found to be an unlawful solicitation of proxies was never mentioned in Karnalyte’s Amended Originating Notice. It was followed by Mr. Brown’s fulsome public apology.

(c) On June 29, 2018, Karnalyte filed a statement of claim against Mr. Brown claiming damages of approximately $1.4 million on the basis of defamation. As was the case with Mr. Phinney, Karnalyte alleged many of the same allegations in the application that it pleads against Mr. Brown in the defamation action. As in Mr. Phinney’s case, many of these allegations were unnecessary to the application, and unproven by the evidence before me.

(d) As Karnalyte failed to provide an affidavit of records in a timely manner in the defamation action, Mr. Brown brought an application to compel it to produce its affidavit of records and was successful, including with an award of costs payable “forthwith”. Again, Karnalyte has not paid the costs. Karnalyte submits that events connected with a separate application are not relevant to this application, but it is clear from the fact that the allegations set out in the defamation action were repeated in this application that the actions are related. Karnalyte alleged in the application that Mr. Brown posted defamatory messages “in furtherance of his strategy to support his improper solicitation of proxies”.

(e) Mr. Brown made a formal offer to Karnalyte for a consent dismissal order in regards to the remedies sought against Mr. Brown on January 25, 2019, on the basis that Karnalyte would pay Mr. Brown’s costs pursuant to Schedule C, column 2. Karnalyte did not accept the offer.

Karnalyte submits that this offer is irrelevant as it was partially successful against Mr. Brown. Although the offer does not support an award of double costs, when combined with Mr. Brown’s other conduct in the litigation, it illustrates his attempts to shorten or avoid the action.

Page: 7

[23] I note that Karnalyte claimed the following relief against Mr. Brown in its Amended Originating Notice:

(a) a declaration that Mr. Brown had engaged in improper proxy solicitation;

(b) a declaration that Mr. Brown was acting in concert with Mr. Phinney and Mr. Van Dam;

(c) a declaration that Mr. Brown failed to discharge his obligation to comply with the early warning system set out in securities regulation;

(d) a declaration that Mr. Brown failed to comply with the requirements of corporate and securities regulations with respect to solicitation of proxies, disposition of shares, filing of early warning disclosure, dissident proxy circulars, continuous disclosure obligations, proxy forms and collective and joint communications;

(e) a declaration that any votes cast that were obtained by improper proxy solicitation were invalid and a nullity and to be disregarded with respect to the counting of votes at the 2018 AGM; and

(f) a declaration that Karnalyte shall be entitled to recount all votes and adjust the recording and publication of voting results for the 2018 AGM.

[24] As noted, the only relief sought by Karnalyte with respect to Mr. Brown’s conduct that was successful was my finding that Mr. Brown had published an improper proxy solicitation on May 28, 2018. I found that the posting was the only evidence against Mr. Brown relating to proxy solicitation, that it was not evidence that Mr. Brown was acting in concert with Mr. Phinney before the posting and that Karnalyte suffered no damages from this solicitation.

[25] With respect to the other relief sought, I concluded that there was no evidence of Mr. Brown and Mr. Van Dam acting jointly or in concert in any way and that the uncontradicted and credible evidence of both was that they had never met, and had never communicated with each other. I found that there was no persuasive evidence that Mr. Brown and Mr. Phinney were acting jointly or in concert with each other.

[26] I further noted that, given that Mr. Brown had issued a full public apology prior to the AGM, had refrained from posting any further negative comments about Karnalyte’s management nominees and in fact had posted a message to the chatroom requesting that other parties not display the names of any Karnalyte directors, management or any other party involved in the forum in a negative light, no further remedy was necessary against Mr. Brown. I commented that Mr. Brown was caught up in a vicious battle among old enemies.

[27] Therefore, despite Karnalyte’s marginal success in the application, I find that, given Karnalyte’s conduct during the litigation and Mr. Brown’s attempts to shorten or avoid the litigation against him, it is in the interest of justice that Mr. Brown be awarded solicitor-client costs in the amount of $49,649.50 inclusive of disbursements and other charges.

[28] Again, it is not necessary to address the alternative relief sought.

Page: 8

IV. Other Relief

[29] Mr. Phinney applies for an order that the Karnalyte action 1801-09478 against him filed on July 4, 2018, which sets out many of the same allegations against Mr. Phinney that were made in the application and claims damages of $5 million plus punitive, exemplary and aggravated damages, be stayed until such time as any cost award made with respect to this action is paid in full.

[30] Mr. Brown seeks the same relief with respect to the collateral defamation action that Karnalyte filed against him on June 29, 2018.

[31] Given that Karnalyte has failed to pay costs awards made against it in favor of Mr. Brown with respect to two applications in which Mr. Brown was successful, despite directions to do so “forthwith”, I find this relief to be appropriate , and I grant it.

[32] Mr. Phinney and Mr. Brown have been entirely successful in this application for costs. In order to avoid further litigation on the point, I direct that they are each are entitled to their costs of the application in the amount of $ 3,000.00.

Dated at Calgary, Alberta this 11th day of January, 2021.

Justice BE Romaine JCQBA

Appearances:

Ariel breitman

for the Plaintiff / Applicant Karnalyte Resources Inc.

William Katz and Geoffrey Boddy

for the Defendant / Respondent Dan Brown

Matthew J. Epp / Matthew Schneider

for the Defendant / Respondent Robin Phinney

Oliver hanson

for the Defendant / Respondent David Van Dam

Robin phinney

------ Original

Message ------

From: [email protected]

To: [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected]

Sent: Saturday, January 22, 2022 4:51 PM

Subject: Fwd: voter fraud

www.krnshareholders.com

Sent: Saturday, January 22, 2022 4:48 PM

Subject: voter fraud

Subject: voter fraud

https://fcaa.gov.sk.ca/public/plugins/pdfs/2581/11_704_sk_staff_notice_january_19_2020.pdf

Staff Notice 11-704

Claims for Financial Compensation

This staff notice sets out information about how to make a claim for a financial compensation order under section 135.6 of The Securities Act, 1988 (the “Act”).

What is a financial compensation order?

Financial and Consumer Affairs Authority of Saskatchewan (the “Authority”) may make a financial compensation order pursuant to section 135.6 of the Act, upon a request from the Director, following a hearing if, after the hearing, the Authority:

• determines that a person or company has contravened Saskatchewan securities laws,

• determines that the illegal activity has caused a financial loss to a claimant, and

• is able to determine the amount of the financial loss.

In a financial compensation order the Authority orders the person or company that has contravened Saskatchewan securities laws to pay a claimant the amount of money they have lost as a result of the illegal activity. The claimant is then able to enforce the order as if it were a judgment of the Court of Queen’s Bench.

What claims are eligible?

To be eligible, a claim must meet the following criteria:

• there must be evidence of financial loss by the claimant,

• it must be possible to quantify the amount of the financial loss, and

• the loss must have resulted from a person or company’s contravention of Saskatchewan securities laws.

What claims are not eligible?

The following claims are not eligible:

• losses that are caused by changes in the financial markets,

• losses that did not result from a person or company’s contravention of Saskatchewan securities laws,

• if the losses occurred prior to August 15, 2012, losses in excess of $100,000. This is because prior to this date, the Authority was limited to making financial compensation orders of up to $100,000.

When can a claim be made?

Authority staff investigate complaints that a person or company may have contravened Saskatchewan securities laws. When an investigation is complete and there is evidence that the person or company has contravened Saskatchewan securities laws, staff will determine whether to seek an enforcement order from the Authority under the Act. For example, staff may request that

the Authority order (among other things):

• that the exemptions in Saskatchewan securities laws do not apply to a person or company pursuant to clause 134(1)(a),

• that a person or company cease trading in securities or derivatives pursuant to clause

134(1)(d), or

• that a person or company pay an administrative penalty pursuant to section 135.1.

Authority staff consider established criteria when deciding whether to proceed to a hearing before the Authority. The main criteria are:

• there is evidence of a contravention of Saskatchewan securities laws,

• there has been harm to Saskatchewan investors,

• there is a public interest in proceeding to a hearing.

If the case meets the criteria, staff will issue a Notice of Hearing to those who contravened Saskatchewan securities law (the Respondents). The Notice of Hearing will include details of the allegations against the Respondent and the type of order the staff seeks from the Authority, which, if appropriate, may include financial compensation orders pursuant to section 135.6 for those who suffered financial loss.

When the hearing has been completed, if the Authority has made a finding that a person or company has contravened Saskatchewan securities laws, and if the case is one that the Director considers may be appropriate to request financial compensation orders, staff will write letters to those investors that the investigation identified as potentially meeting the criteria for a financial compensation order. In the letter staff will advise investors how to submit a claim, if they want to.

How to make a claim

To make a claim for a financial compensation order, investors must do the following:

• file a claim in Form 11-704F1,

• attach all of the documentation relating to the claim

• provide any further information that staff request, and

• if requested, attend at a hearing to present the documentation and information that supports the claim.

What happens with the claim

Authority staff will review submitted claims and any supporting documentation. Staff may contact an investor with follow up questions. Once all of the claims relating to a matter have been reviewed, staff will prepare a memo with a recommendation for the Director of the Authority’s Securities Division.

Director’s decision

Under subsection 135.6(2) of the Act, the Director must decide whether to request a financial compensation order from the Authority in respect of any claim.

The Director will meet with staff and review each of the claims that has been received in respect of the matter. Staff will provide the Director with a recommendation on each claim.

After hearing from staff, the Director will make a decision about whether, and in what amount, to

request financial compensation from the Authority.

Generally, the Director will request a financial compensation order from the Authority where:

• there is evidence that a claimant suffered a financial loss,

• the financial loss was caused by a Respondents’ contravention of Saskatchewan securities laws, and

• the financial loss is quantifiable.

The Director may not send a claim to the Authority in some situations, such as:

• where there is evidence that the claimant colluded or participated with the Respondent in the contravention of Saskatchewan securities laws, or

• where the complexity of the case and the number of claimants would make it difficult to effectively hold a hearing. In that case the Director might conclude that claim is more properly dealt with by the courts.

Actions in the civil courts

Three provisions in section 135.6 are relevant to actions in the civil courts:

• Subsection 135.6(8) requires claimants to promptly inform the Authority after commencing an action or proceeding for the same loss.

• Subsection 135.6(9) provides that once the Authority opens a hearing where a claim for compensation for financial loss is one of the matters before it, any action or proceeding by a claimant for compensation for the same loss is stayed.

• Subsection 135.6(9.1) provides that nothing in subsection (9) precludes a claimant from commencing an action or proceedings for compensation for the same loss, or any unclaimed loss arising out of the same transaction, after the Authority opens a hearing.

It is recommended that potential claimants get legal advice on these issues.

Financial compensation hearings

If the Director has made a request for financial compensation from the Authority, a financial compensation hearing will be held. Financial compensation hearings are open to the public. Reporters may be present, and they may report details of the proceedings including the name of claimants and the amounts that they are claiming. Claimants have the right to be present, and to be represented by counsel. Staff will present evidence to support the claims for financial compensation, including evidence of financial loss. Claimants may also be called upon to present their own evidence or information as well.

The Respondents have the right to challenge the evidence presented, and to present their own evidence. Part 13 of Local Policy 12-602 Procedure for Hearings and Reviews sets out procedures that apply where there is a request for a financial compensation order.

Authority’s decision following a financial compensation hearing

The Authority will consider the evidence presented at the hearing, and will make a decision, along with written reasons. If the decision is made to grant a request for financial compensation, staff will take out an order on the investor’s behalf and provide a copy to the investor.

Orders for financial compensation

A financial compensation order by the Authority will set out the amount to be paid, by whom that

amount is to be paid and to whom. Staff will notify claimants of the Authority’s decision. If you have received a financial compensation order, then you can file the order as a judgment with the Court of Queen’s Bench of Saskatchewan. You are responsible for taking whatever action is required to collect on the judgment.

January 1, 2008

Amended May 4, 2009

Amended May 7, 2015

Amended January 14, 2020

Contact:

Director, Securities Division

(306) 787-5842

Schedule A to Staff Notice 11-704 Claims for Financial Compensation

Financial compensation

135.6(1) In this section, a person or company is employed by another person or company when:

(a) an employer-employee relationship exists; or

(b) the first person or company is registered pursuant to this Act as an employee, agent or representative of the second person or company.

(2) On the application of a claimant, the Director may, when the Commission holds a hearing about a person or company, request the Commission to make an order that the person or company pay the claimant compensation for financial loss.

(3) Notwithstanding subsection 10(2), the Director’s decision whether to make a request is not subject to review.

(4) If requested by the Director to do so, the Commission may order the person or company to pay the claimant compensation for the claimant’s financial loss, if, after the hearing, the Commission:

(a) determines that the person or company has contravened or failed to comply with:

(i) Saskatchewan securities laws;

(ii) a written undertaking made by the person or company to the

Commission or the Director; or

(iii) a term or condition of the person’s or company’s registration;

(b) is able to determine the amount of the financial loss on the evidence; and

(c) finds that the person’s or company’s contravention or failure caused the financial loss in whole or in part.

(5) If the contravention or failure occurs in the course of the person’s or company’s employment by another person or company, or while the person or company is acting on behalf of the other in any other capacity, the Commission may order the other person or company to jointly and severally pay the claimant the financial compensation ordered pursuant to subsection (4).

(6) The Commission may make an order notwithstanding:

(a) the imposition of any other penalty or sanction on the person or company;

or

(b) the making of any other order by the Commission related to the same matter.

(7) Repealed. 2008, c.35, s.25.

(8) A claimant shall promptly inform the Commission after commencing an action or proceeding for the same loss.

(9) Once the Commission opens a hearing if a claim for compensation for financial loss is one of the matters before it, any action or proceeding commenced by a claimant for compensation for the same loss, or any unclaimed loss arising out of the same transaction, is stayed until the Commission makes a decision after the hearing.

(9.1) Nothing in subsection (9) precludes a claimant from commencing an action or proceeding for compensation for the same loss, or any unclaimed loss arising out of the same transaction, after the Commission opens a hearing.

(10) Notwithstanding subsection (9), a claimant in whose favour the Commission makes an order may file a certified copy of the order with the local registrar of the Court of Queen’s Bench.

(11) An order filed pursuant to subsection (10) is enforceable as a judgment of the

Court of Queen’s Bench.

From: [email protected]

To: [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected]; [email protected];

[email protected]; [email protected];

[email protected]; [email protected]; [email protected]

Cc: [email protected]

Sent: Friday, January 21, 2022 1:00 PM

Subject: who is in charge

https://www.securities-administrators.ca/resources/access-rules-policies/

Access Rules & Policies

The CSA rules or regulations are largely harmonized as either National or Multilateral Instruments and are numbered in a uniform way. However, they are adopted as local subordinate legislation under each Canadian province’s or territory’s Securities Act or other applicable acts. A National Instrument is an instrument that has been adopted in all thirteen Canadian provinces and territories. A Multilateral Instrument is an instrument that has been adopted in more than one, but not all Canadian provinces and territories.

The list below includes only the National and Multilateral Instruments currently in force. These instruments, as they are in effect in each Canadian province or territory, can be found on the websites of the CSA members:

- British Columbia Securities Commission

- Alberta Securities Commission

- Financial and Consumer Affairs Authority of Saskatchewan

- The Manitoba Securities Commission

- Ontario Securities Commission

- Autorité des marchés financiers

- Financial and Consumer Services Commission (New Brunswick)

- Nova Scotia Securities Commission

- Office of the Superintendent of Securities, Service Newfoundland & Labrador

- The Office of the Superintendent of Securities (Prince Edward Island)

- The Office of the Superintendent of Securities, Northwest Territories

- Office of the Yukon Superintendent of Securities

- Office of the Superintendent of Securities, Nunavut

Click here for PDF version of this list (PDF). Note National instruments, multilateral instruments, national policies and CSA notices are not available on the CSA website but rather on our members’ websites.

1. Procedure and Related Matters

- Multilateral Instrument 11-102 Passport System

In effect: Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Québec, Saskatchewan, Yukon

Not in effect: Ontario

- Multilateral Instrument 11-103 Failure-to-File Cease Trade Orders in Multiple Jurisdictions

In effect: British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nunavut, Prince Edward Island, Saskatchewan, Yukon

Not in effect: Alberta, Nova Scotia, Ontario, Québec

Note: Alberta, Nova Scotia and Québec have not adopted MI 11-103 because they are relying on their respective statutory provisions providing for automatic reciprocation of enforcement orders from other jurisdictions, which substantively provide the same result as MI 11-103. British Columbia, Saskatchewan and Manitoba also have a similar statutory provision but MI 11-103 remains in effect in those provinces. New Brunswick is in the process of repealing MI 11-103 because it has adopted a similar statutory provision. Ontario currently does not have a statutory provision for automatic reciprocation of enforcement orders.

- National Instrument 13-101 System for Electronic Document Analysis and Retrieval (SEDAR)

- Multilateral Instrument 13-102 System Fees for SEDAR and NRD

Note: This instrument has been implemented by all CSA members either by rule or by regulation. It remains a multilateral instrument because Manitoba does not have legislative authority to adopt it as a rule, and instead implemented the same requirements as a regulation: Regulation 158/2013 under the Manitoba Securities Act, System Fees for SEDAR and NRD Regulation

- National Instrument 14-101 Definitions

2. Certain Capital Market Participants

- National Instrument 21-101 Marketplace Operation

- National Instrument 23-101 Trading Rules

- National Instrument 23-102 Use of Client Brokerage Commissions

- National Instrument 23-103 Electronic Trading and Direct Access to Marketplaces

- National Instrument 24-101 Institutional Trade Matching and Settlement

- National Instrument 24-102 Clearing Agency Requirements

- National Instrument 25-101 Designated Rating Organizations

3. Registration and Related Matters

- National Instrument 31-102 National Registration Database

- National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations

- Multilateral Instrument 32-102 Registration Exemptions for Non-Resident Investment Fund Managers

In effect: Newfoundland and Labrador, Ontario and Québec

Not in effect: Alberta, British Columbia, Manitoba, New Brunswick, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Saskatchewan, Yukon

Note: The non-participating jurisdictions have instead adopted Multilateral Policy 31-202 Registration Requirement for Investment Fund Managers. The interpretation of the investment fund manager registration requirement in these jurisdictions is significantly different from MI 32-102.

4. Distribution Requirements

- National Instrument 41-101 General Prospectus Requirements

- National Instrument 43-101 Standards of Disclosure for Mineral Projects

- National Instrument 44-101 Short Form Prospectus Distributions

- National Instrument 44-102 Shelf Distributions

- National Instrument 44-103 Post-Receipt Pricing

- National Instrument 45-102 Resale of Securities

- National Instrument 45-106 Prospectus Exemptions

- Multilateral Instrument 45-107 Listing Representation and Statutory Rights of Action Disclosure Exemption

In effect: Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Québec, Saskatchewan, Yukon

Not in effect: British Columbia, Ontario

Note: British Columbia and Ontario chose not to participate in MI 45-107 because they each have a measure that addresses the same issues (OSC Rule 45-501 Ontario Prospectus and Registration Exemptions and BCSC Notice 47-701 Blanket Permission under Section 50(1)(c) of the Securities Act)

- Multilateral Instrument 45-108 Crowdfunding

In effect: Alberta, Manitoba, New Brunswick, Nova Scotia, Ontario, Québec, Saskatchewan

Not in effect: British Columbia, Newfoundland and Labrador, Prince Edward Island, Northwest Territories, Nunavut, Yukon

5. Ongoing Requirements for Issuers and Insiders

- National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities

- National Instrument 51-102 Continuous Disclosure Obligations

- Multilateral Instrument 51-105 Issuers Quoted in the U.S. Over-the-Counter Markets

In effect: Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Québec, Saskatchewan, Yukon

Not in effect: Ontario

- National Instrument 52-107 Acceptable Accounting Principles and Auditing Standards

- National Instrument 52-108 Auditor Oversight

- National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings

- National Instrument 52-110 Audit Committees

- National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer

- National Instrument 55-102 System for Electronic Disclosure by Insiders (SEDI)

- National Instrument 55-104 Insider Reporting Requirements and Exemptions

- National Instrument 58-101 Disclosure of Corporate Governance Practices

6. Take-Over Bids and Special Transactions

- Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions

In effect: Alberta, Manitoba, New Brunswick, Ontario, Québec, Saskatchewan

Not in effect: British Columbia, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Yukon

- National Instrument 62-103 The Early Warning System and Related Take-Over Bid and Insider Reporting Issues

- National Instrument 62-104 Take-Over Bids and Issuer Bids

7. Securities Transactions Outside the Jurisdictions

- National Instrument 71-101 The Multijurisdictional Disclosure System

- National Instrument 71-102 Continuous Disclosure and Other Exemptions Relating to Foreign Issuers

8. Investment Funds

- National Instrument 81-101 Mutual Fund Prospectus Disclosure

- National Instrument 81-102 Investment Funds

- National Instrument 81-104 Alternative Mutual Funds

- National Instrument 81-105 Mutual Fund Sales Practices

- National Instrument 81-106 Investment Fund Continuous Disclosure

- National Instrument 81-107 Independent Review Committee for Investment Funds

9. Derivatives

- Multilateral Instrument 91-101 Derivatives: Product Determination

In effect: Alberta, British Columbia, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Saskatchewan, Yukon

Not in effect: Manitoba, Ontario, Québec

Note: The derivatives product determination regime is largely harmonized across Canada because MSC Rule 91-506 Derivatives: Product Determination, OSC Rule 91-506 Derivatives: Product Determination and AMF Regulation 91-506 respecting Derivatives Determination provide substantively the same result as MI 91-101

- National Instrument 94-101 Mandatory Central Counterparty Clearing of Derivatives

- National Instrument 94-102 Derivatives: Customer Clearing and Protection of Customer Collateral and Positions

- Multilateral Instrument 96-101 Trade Repositories and Derivatives Data Reporting

In effect: Alberta, British Columbia, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Prince Edward Island, Saskatchewan, Yukon

Not in effect: Manitoba, Ontario, Québec

Note: The derivatives reporting regime is largely harmonized across Canada because Rule 91-507 Trade Repositories and Derivatives Data Reporting, Exemption for Trade Repositories from certain trade reporting requirements in Manitoba Securities Commission Rule 91-507, OSC Rule 91-507 Trade Repositories and Derivatives Data Reporting and AMF Regulation 91-507 respecting Trade Repositories and Derivatives Data Reporting provide substantively the same result as MI 96-101.

* Information was last updated on December 12, 2020.

------ Original Message ------

From: [email protected]

To: [email protected]

Sent: Wednesday, January 19, 2022 10:31 AM

Subject: Fwd: Your email to our Office

FYI

---------- Forwarded message ---------

From: INFO <[email protected]>

Date: Wed, Jan 19, 2022 at 8:13 AM

Subject: Re: Your email to our Office

To: [email protected] <[email protected]>Our File No. 401568This is in response to your email to our Office complaining about voter fraud/suppression that took place at the Karnalyte Resources 2018 annual meeting.The Ontario Ombudsman is appointed under the Ombudsman Act as an Officer of the Ontario Legislature, independent of political parties and government administrators. Our Office has the authority to conduct impartial reviews and investigations of complaints regarding the administrative conduct of provincial government organizations. We also have the authority to review the administrative conduct of municipal sector entities, publicly funded universities, and school boards, as well as complaints about the provision of French language services, children’s aid societies and residential licensee services.However, our Office’s oversight does not include private bodies, such as Karnalyte Resources and as such; we are unable to review the issues you have raised.I note that you have also sent your email to the Ontario Securities Commission (OSC). Given the available avenues to address your concerns with the OSC, our Office’s involvement is premature at this time. Our Office does have jurisdiction over the OSC, and I invite you to contact us again if you receive a response from the OSC that raises concerns about their administrative conduct.At that time we can review the response and determine our role, if any.I hope that the information provided may be helpful to you.Please feel free to contact our Office again if you wish to complain about a government organization, within our jurisdiction.Thank you for contacting the Office of the Ombudsman of Ontario.Regards,Calum McCowanInformation OfficerOffice of the Ombudsman of Ontario | Bureau de l’Ombudsman de l’Ontario

1-800-263-1830 - Complaints Line | Ligne des plaintes

1-866-411-4211 - TTY | ATS

www.ombudsman.on.ca | Facebook | Twitter

Subscribe to our e-newsletter | Abonnez-vous à notre e-bulletinThis email is intended only for the named recipient(s) and may contain confidential information, protected under the Ombudsman Act. If you receive it by error, please notify the sender and delete this message without delay, and do not use, distribute, copy, or disclose its contents.

Ce courriel est uniquement adressé au(x) destinataire(s) nommé(s) et peut contenir de l'information confidentielle, protégée en vertu de la Loi sur l'ombudsman. Si vous le recevez par erreur, veuillez aviser l’expéditeur et supprimer ce message au plus vite, sans utiliser, distribuer, copier ou divulguer son contenu.

June 4, 2018 - Running total Voter Fraud #3

[Edit : New totals - So with these 5 voter frauds, KARNALYTE LOST!! the vote in any scenario.

Regulators, there are 36 MORE voter fraud items.

At which point are you going to take action? ]

| Today's Vote Totals the Karnalyte changed (abstained) | 1,964,548 | ||||

| Election of Directors | (2018 Results) | (From Sedar.com) | |||

| Name | Votes For | %Votes For | Votes Withheld | %Votes Withheld | |

| Mark Zachanowich | 9,697,555 | 55.31 | 7,837,010 | 44.69 | |

| W. Todd Rowan | 9,639,041 | 54.97 | 7,895,524 | 45.03 | |

| Peter Matson | 9,680,555 | 55.21 | 7,854,010 | 44.79 | |

| Gregory Szabo | 9,697,555 | 55.31 | 7,837,010 | 44.69 | |

| Vishvesh D. Nanavaty | 9,594,051 | 54.72 | 7,940,514 | 45.28 | |

| Sanjeev V. Varma | 9,579,051 | 54.63 | 7,955,514 | 45.37 | |

| Diff of votes | New votes removed | New Voted For % | New votes added | Today's Diff | New Votes Witheld NOW |

| -1,860,545 | 7,733,007 | 44.10% | 9,801,558 | 2,068,551 | 55.90% |

| -1,743,517 | 7,674,493 | 43.77% | 9,860,072 | 2,185,579 | 56.23% |

| -1,826,545 | 7,716,007 | 44.00% | 9,818,558 | 2,102,551 | 56.00% |

| -1,860,545 | 7,733,007 | 44.10% | 9,801,558 | 2,068,551 | 55.90% |

| -1,653,537 | 7,629,503 | 43.51% | 9,905,062 | 2,275,559 | 56.49% |

| -1,623,537 | 7,614,503 | 43.43% | 9,920,062 | 2,305,559 | 56.57% |

| And even to give the benefit of doubt Original KRN Values NOT Changed | |||||

| not removing votes Orginal Values | New Voted For % | New votes added | Today's Diff | New Votes Witheld NOW | |

| 9,697,555 | 49.73% | 9,801,558 | 104,003 | 50.27% | |

| 9,639,041 | 49.43% | 9,860,072 | 221,031 | 50.57% | |

| 9,680,555 | 49.65% | 9,818,558 | 138,003 | 50.35% | |

| 9,697,555 | 49.73% | 9,801,558 | 104,003 | 50.27% | |

| 9,594,051 | 49.20% | 9,905,062 | 311,011 | 50.80% | |

| 9,579,051 | 49.13% | 9,920,062 | 341,011 | 50.87% | |

January 14, 2022

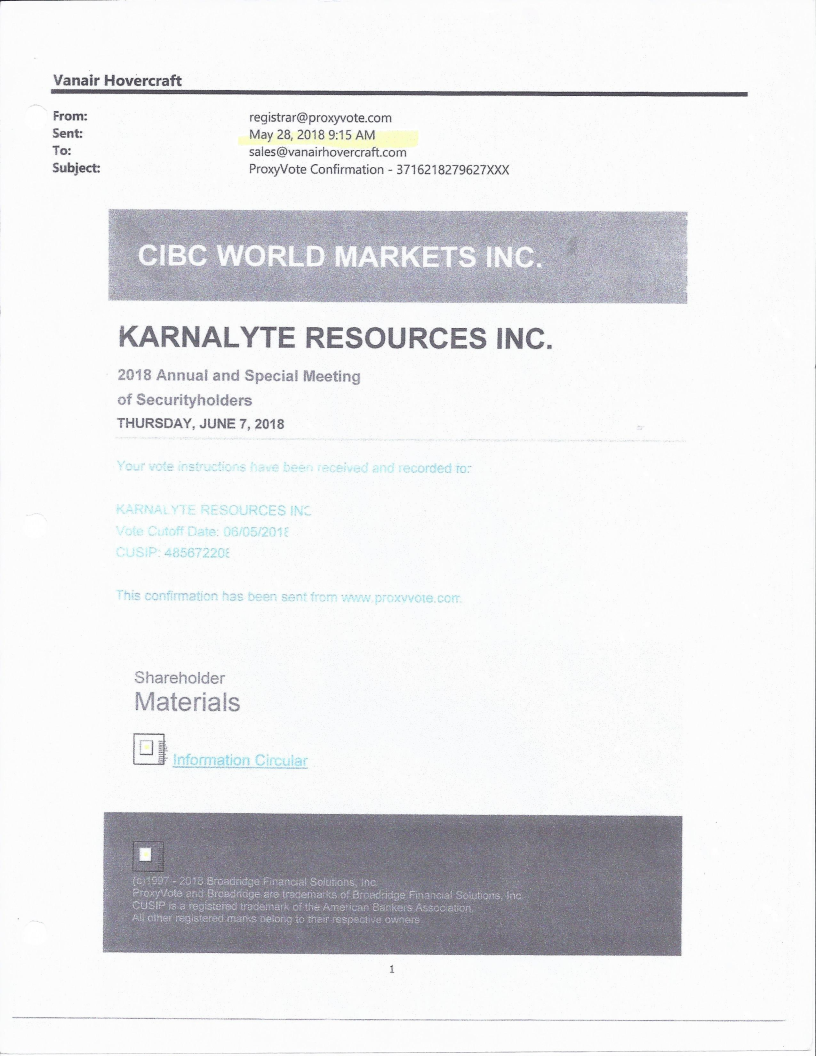

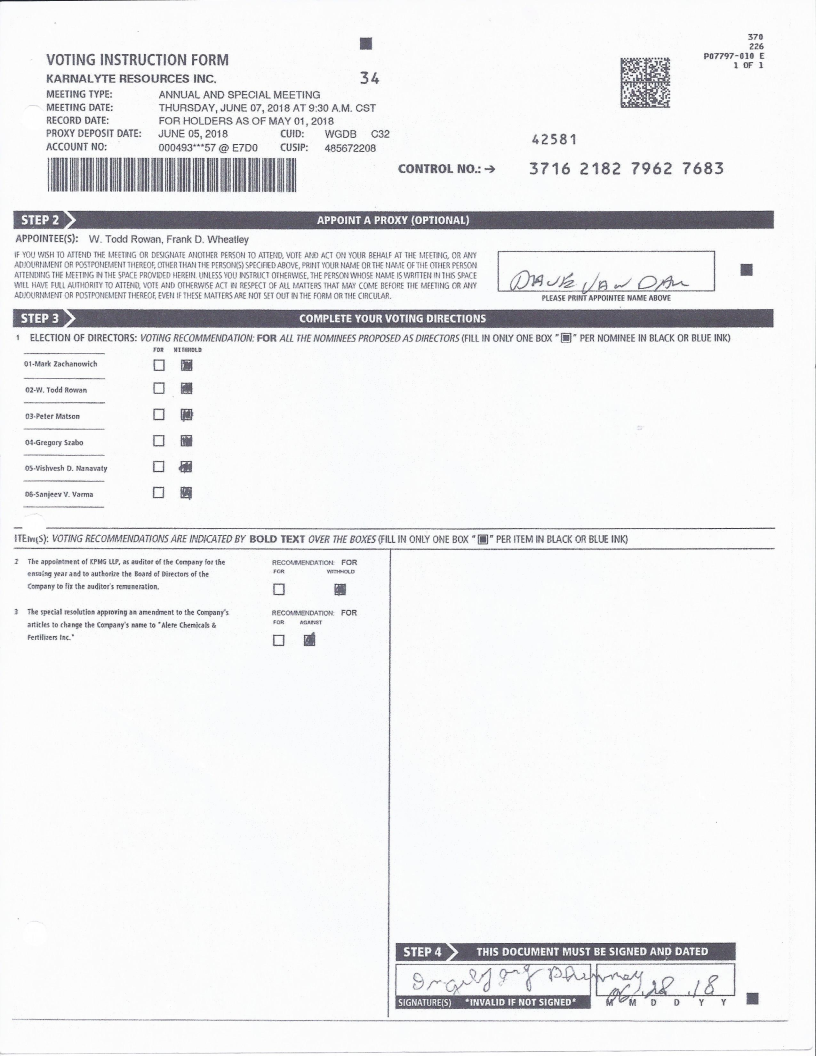

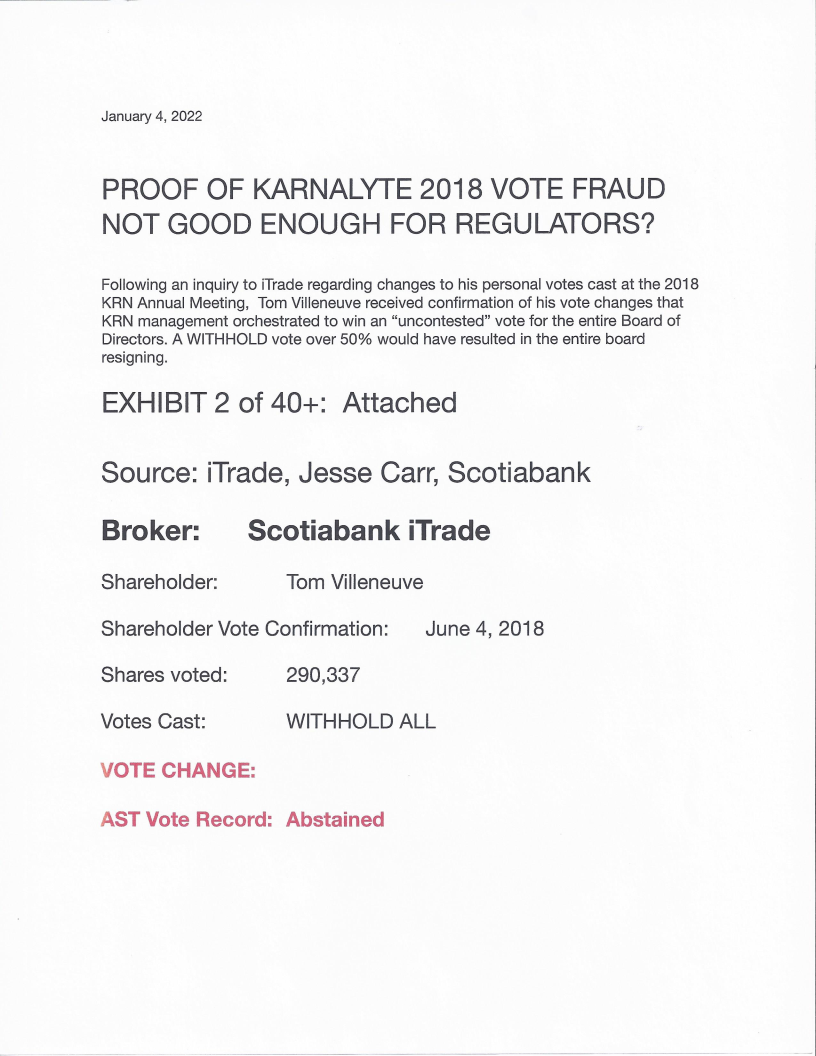

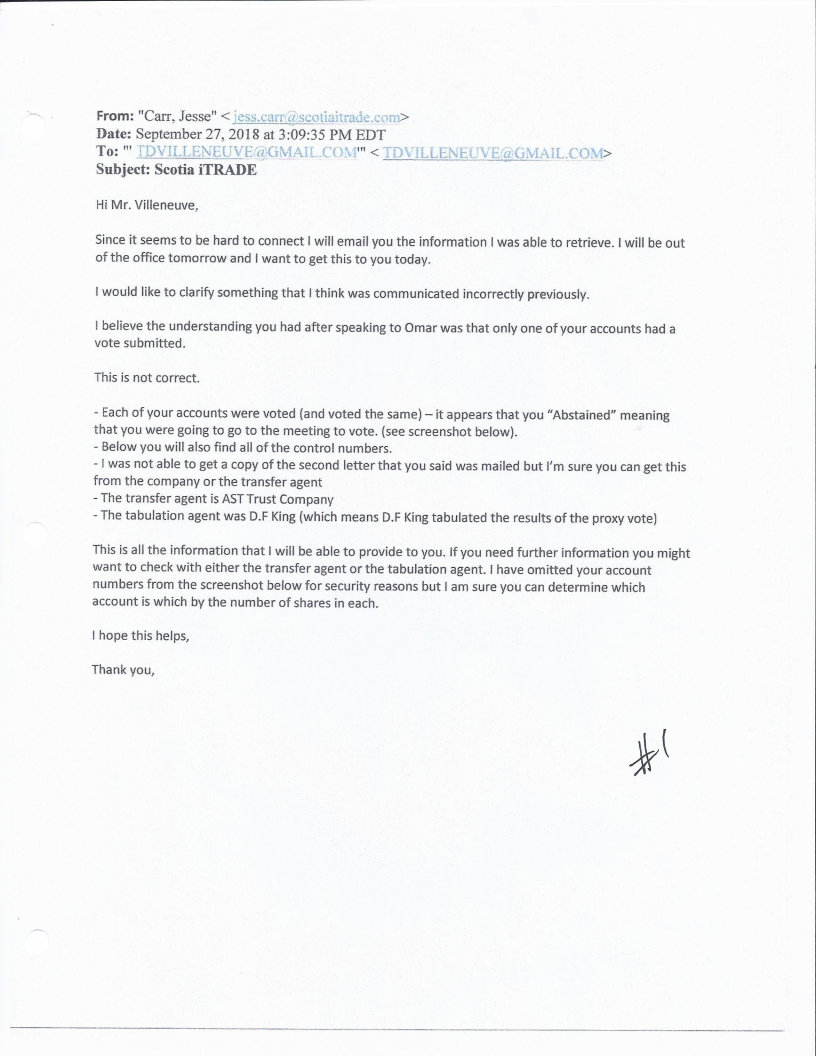

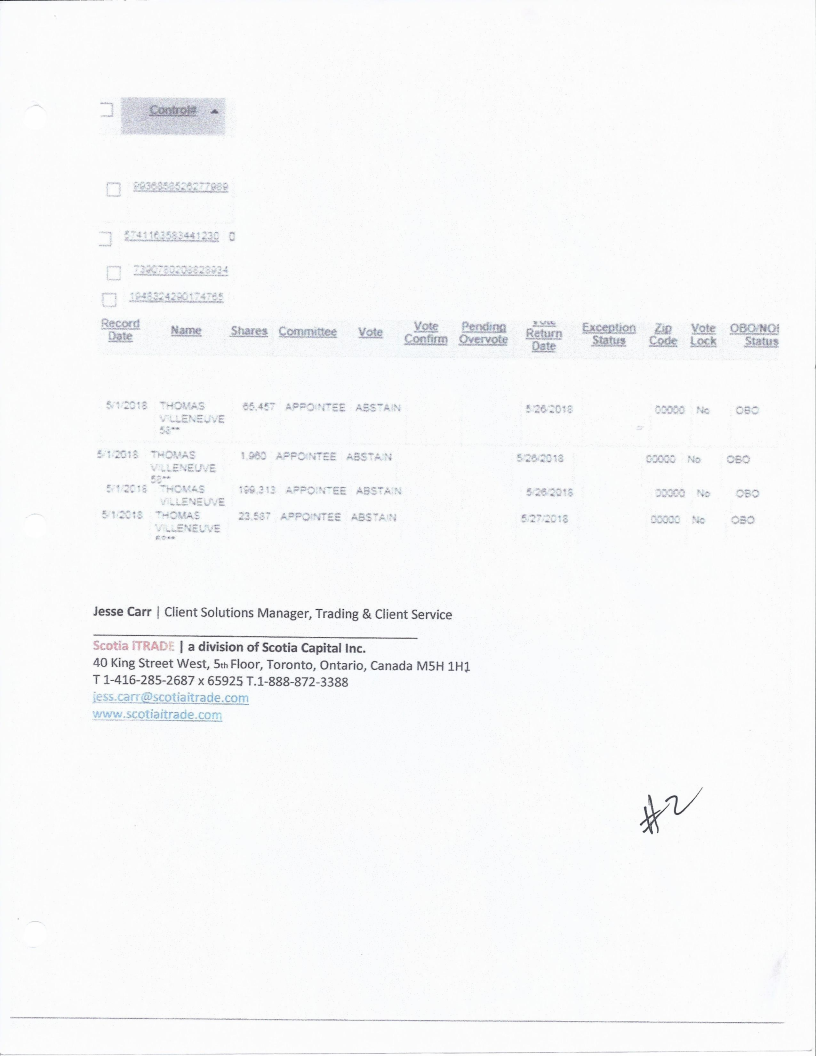

PROOF OF KARNALYTE 2018 VOTE FRAUD

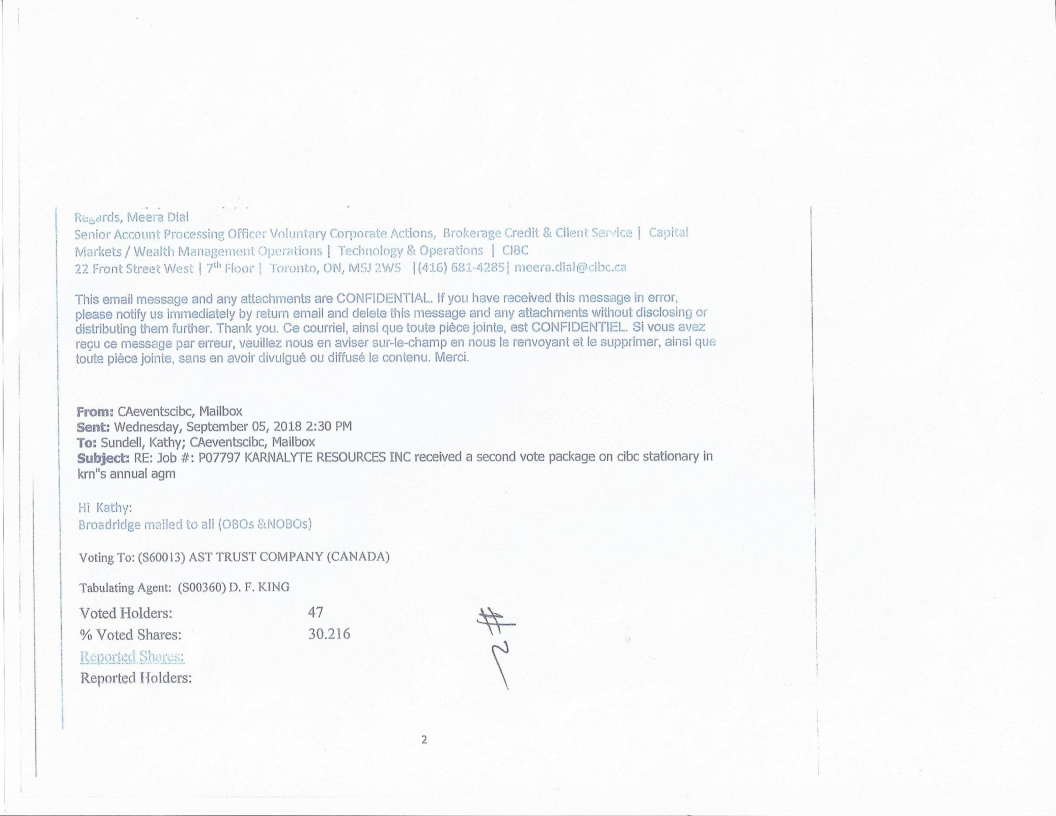

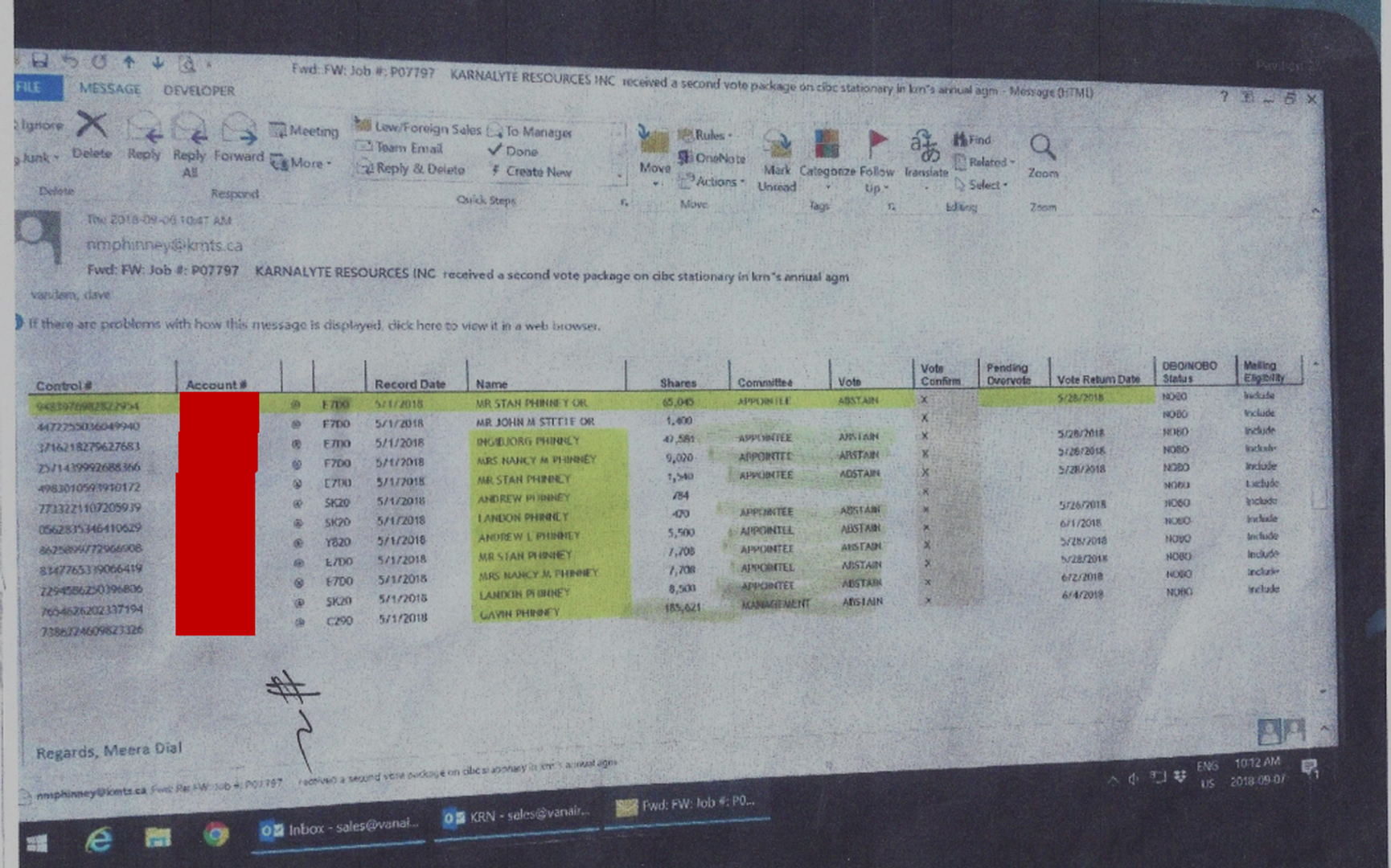

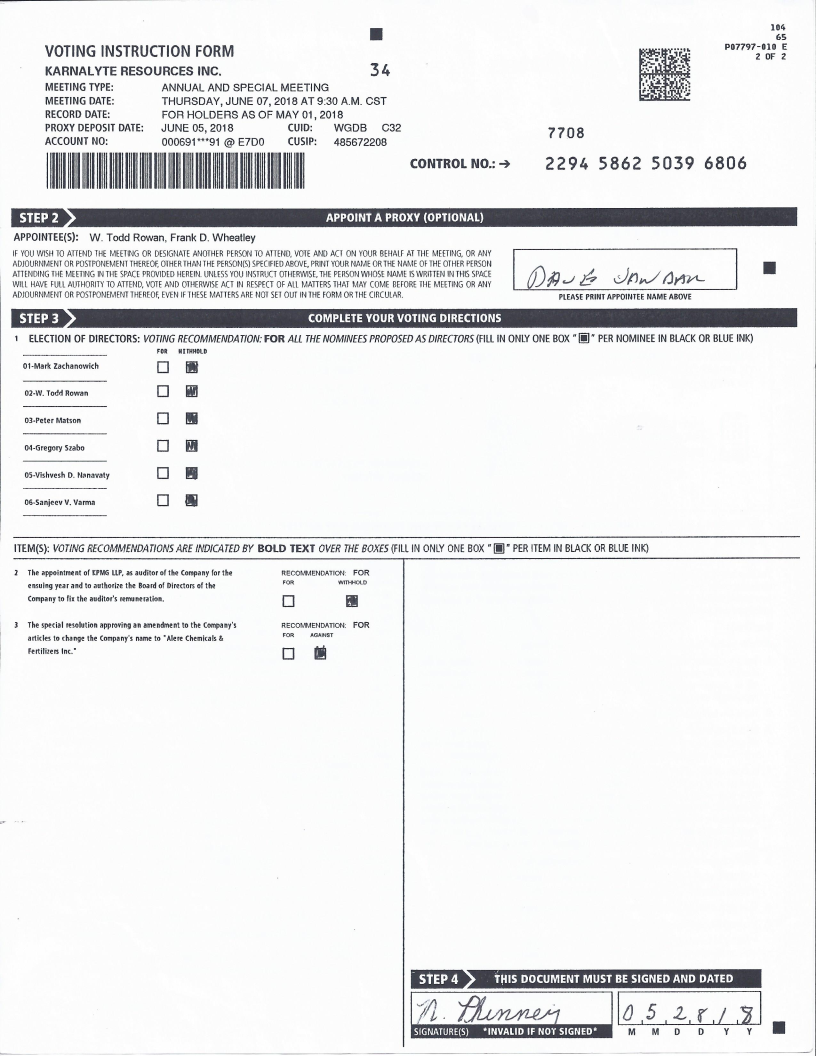

Following an inquiry to CIBC regarding changes to his personal votes cast at the 2018 KRN Annual Meeting, Stan Phinney received confirmation of multiple vote changes that KRN management orchestrated to win an “uncontested” vote for the entire Board of Directors. A WITHHOLD vote over 50% would have resulted in the entire board resigning.

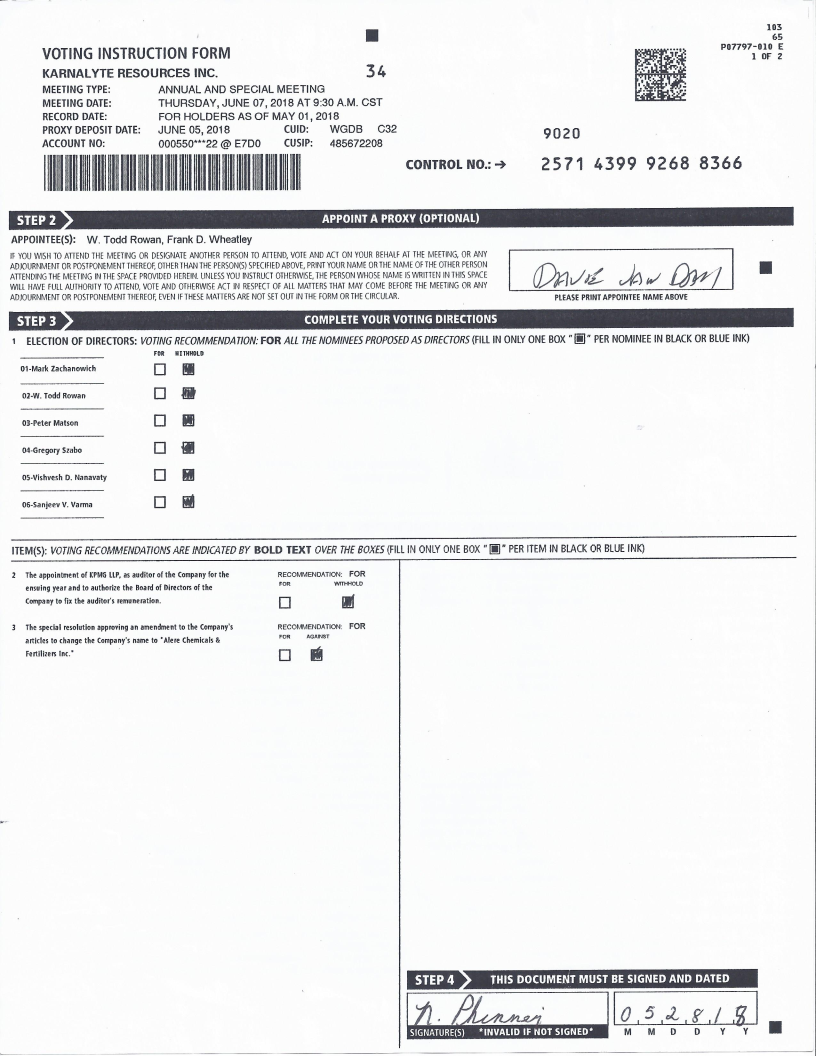

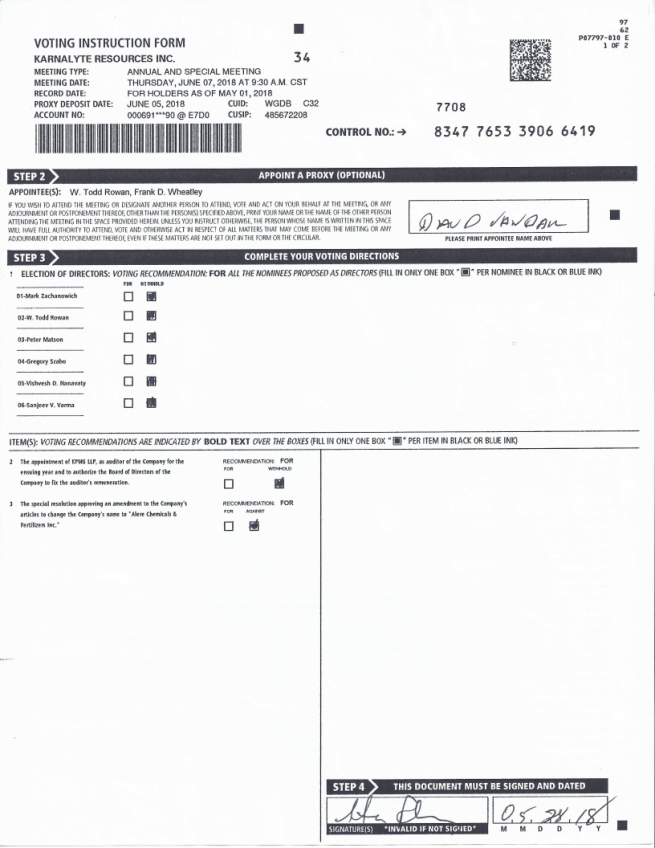

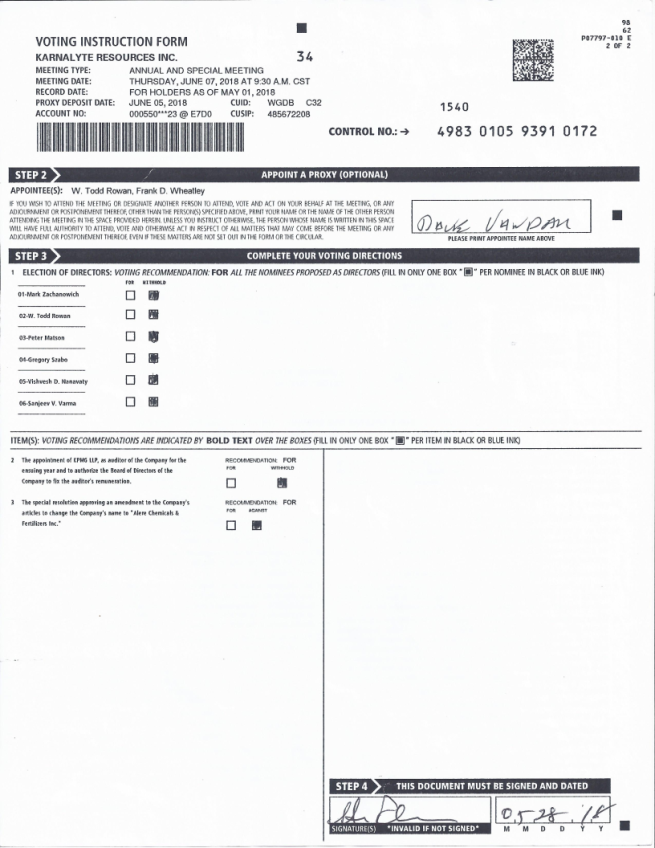

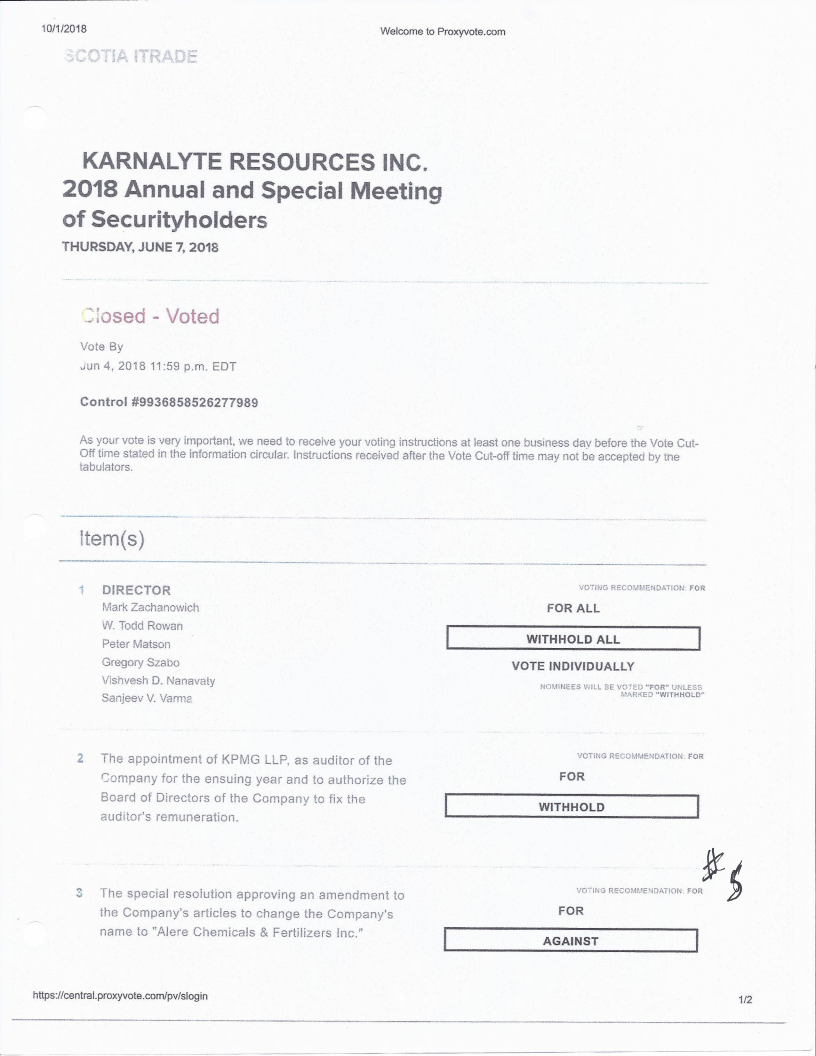

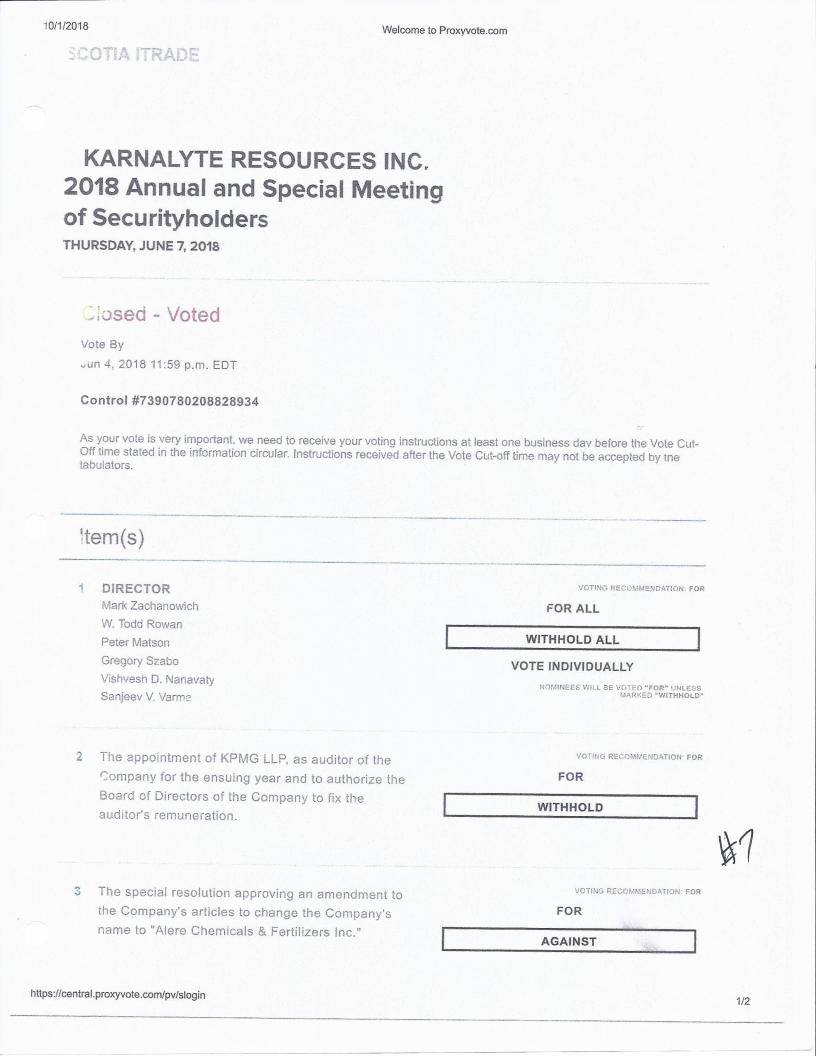

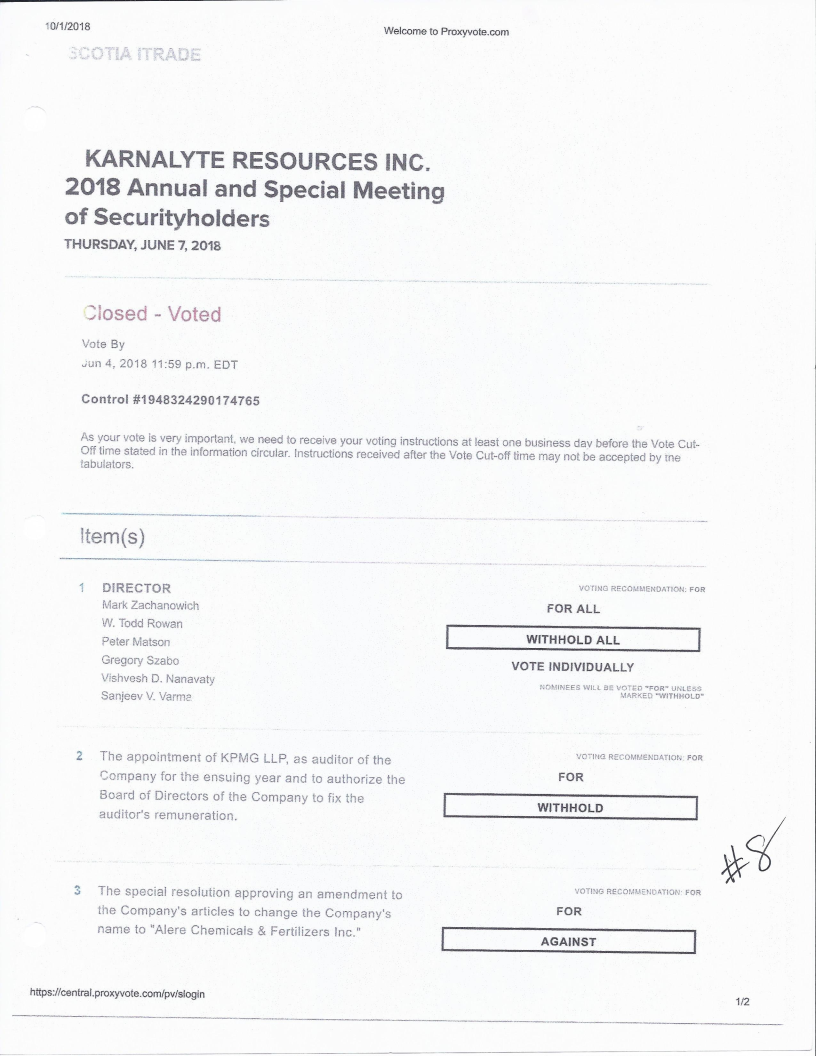

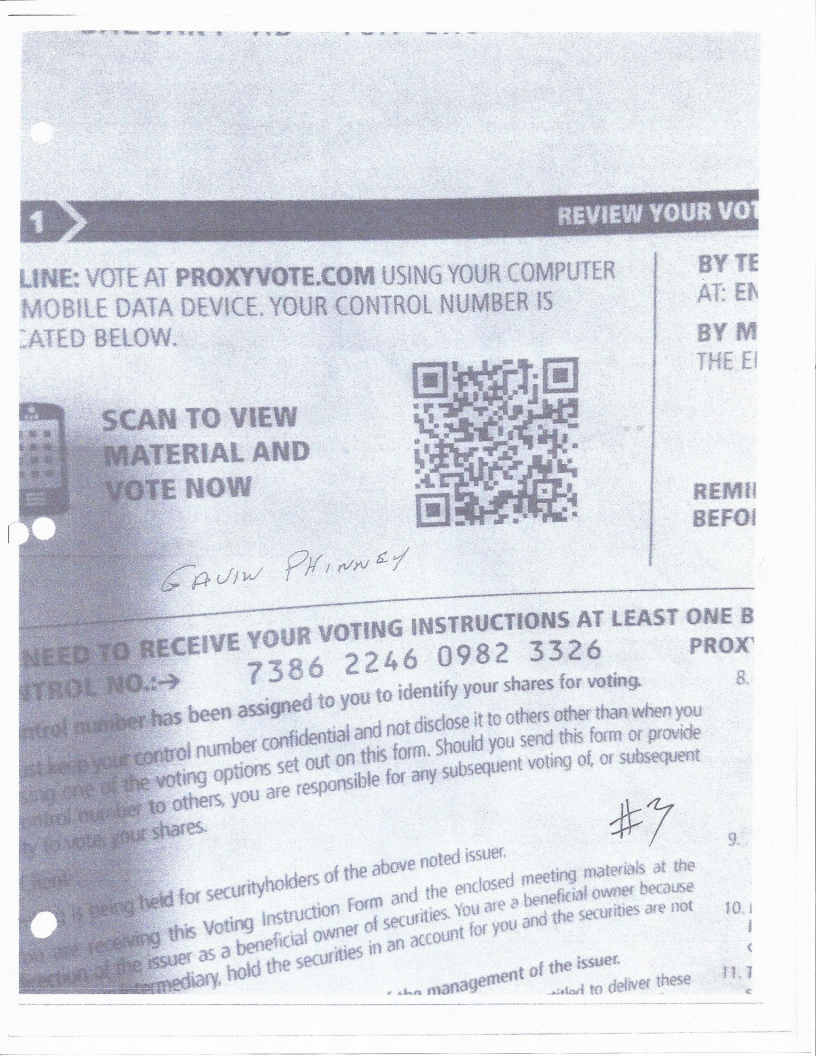

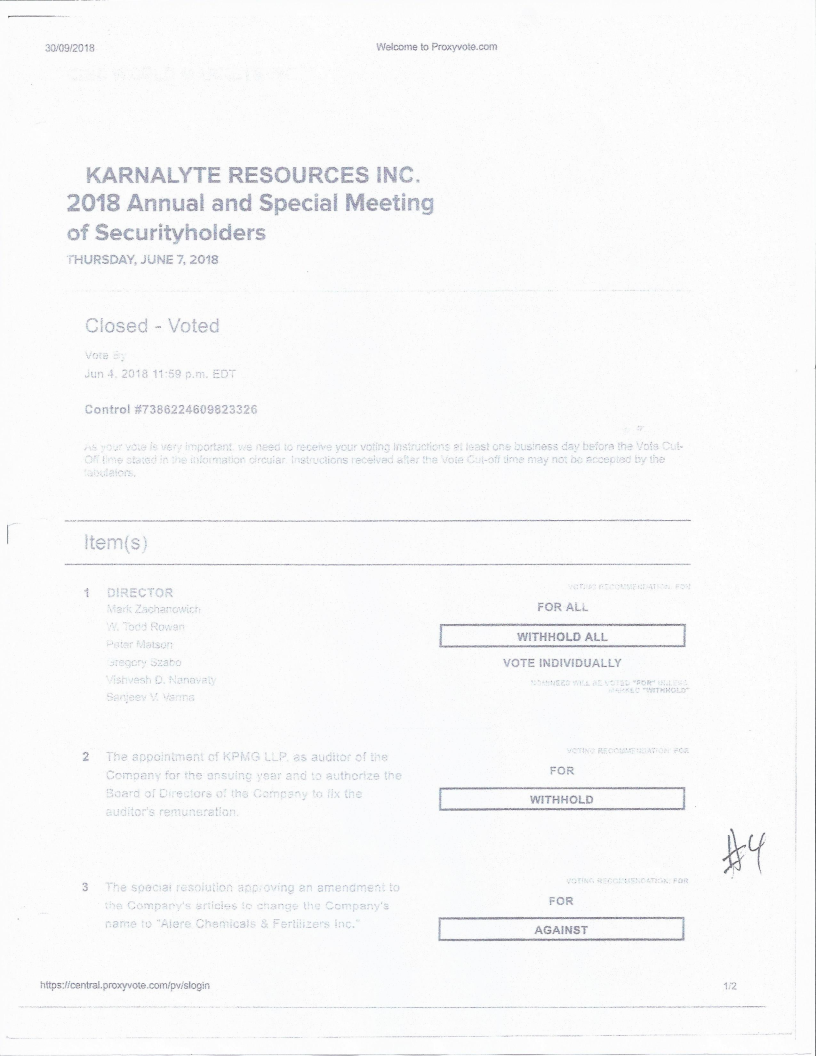

EXHIBIT 5 of 40+: See Attached Source: AST proxyvote.com

via Meera Dial, Senior Account Processing Officer, CIBC

Broker: CIBC Wood Gundy

Shareholder: Nancy PHINNEY Shareholder Vote Confirmation: June 4, 2018

Shares voted: 16,708

Votes Cast: WITHHOLD ALL

VOTE CHANGED: WITHOLD ALL to ABSTAINED (not counted)

AST Vote Record: Abstained

Page 2

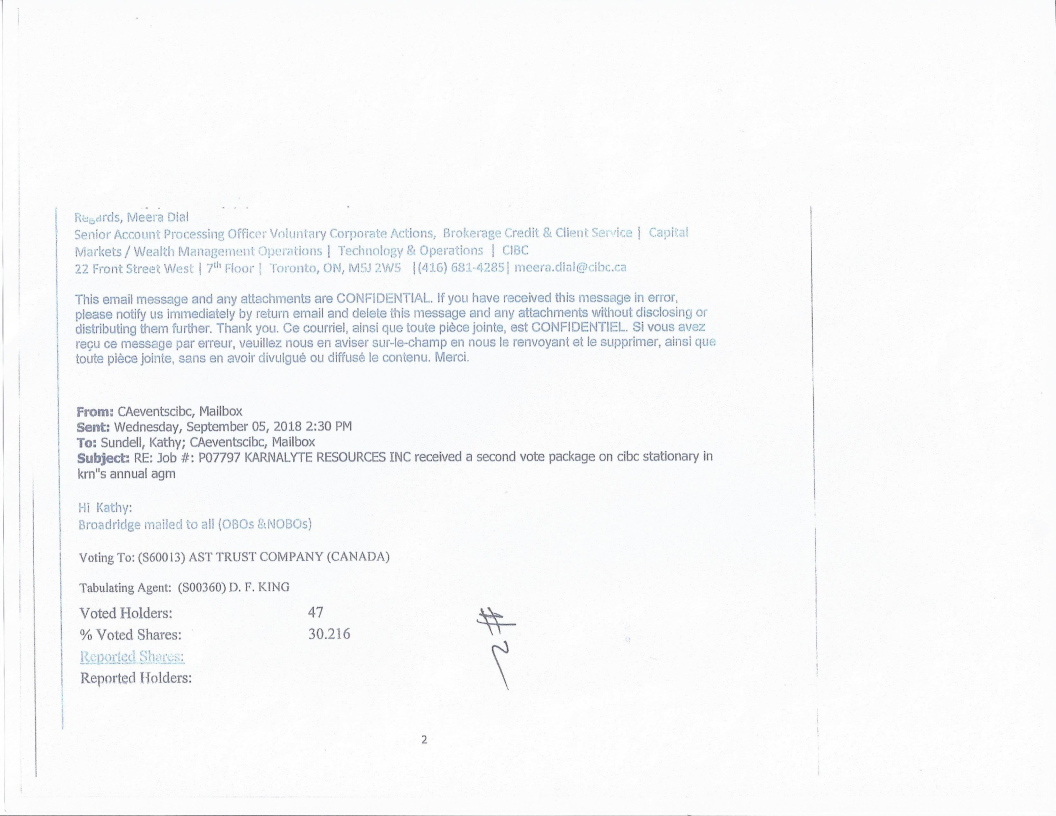

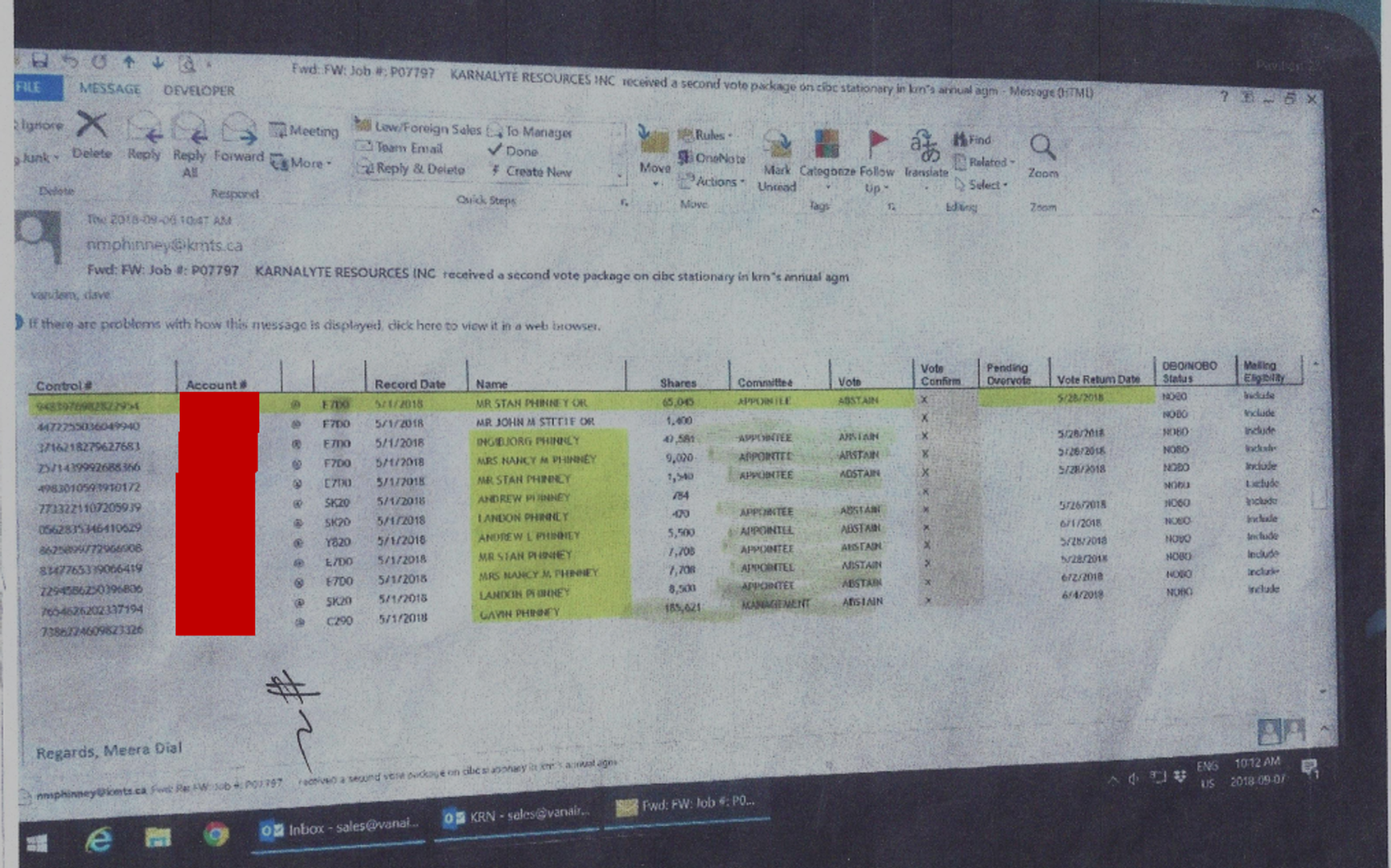

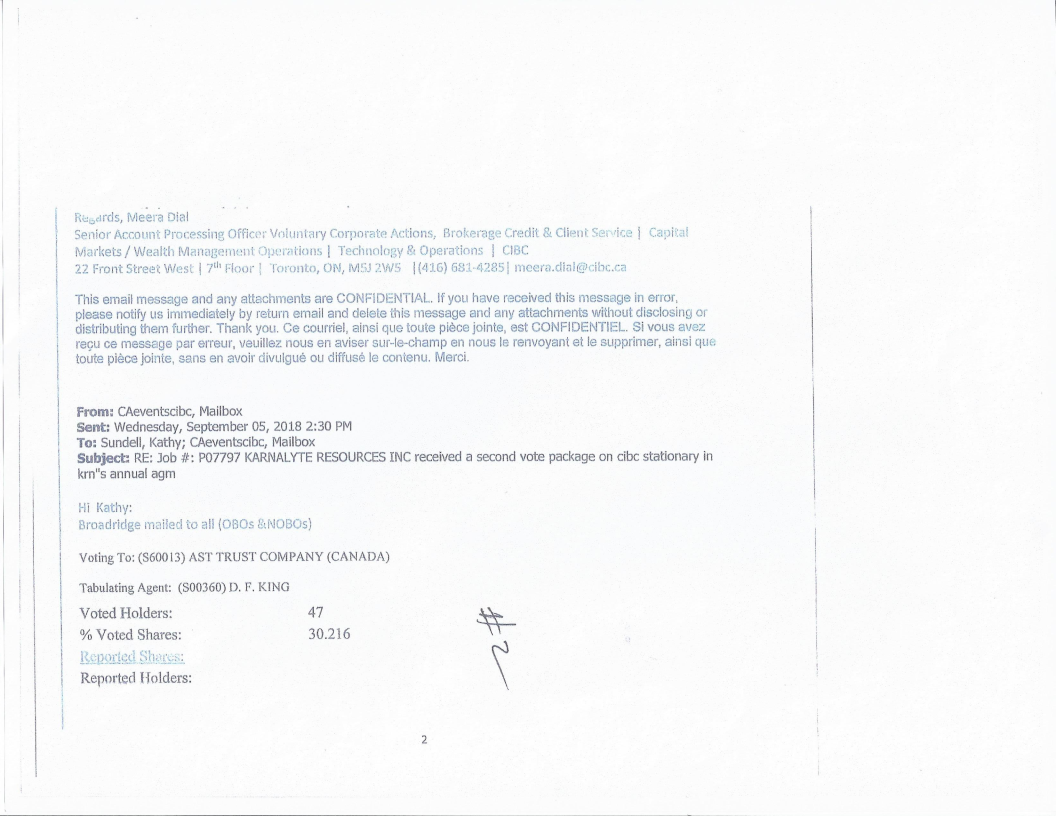

Attachment 1: Screenshot of file sent to Stan Phinney from Kathy Sundell CIBC, in response to his complaint about a second voter package sent out by AST/King using the same proxy numbers. This led to the discovery that AST could reopen the CLOSED vote files and alter the vote from WITHHOLD ALL to ABSTAIN.

Attachment 2: Email communication between Meera Dial, CIBC Toronto and Kathy Sundell, CIBC Wood Gundy, Thunder Bay.

Attachment 3:

Nancy Phinney’s Control Numbers : 2294 5862 5039 6806

2571 4399 9268 8366

Attachment 4: Nancy Phinney’s Vote Record with confirmation number - Vote cast: WITHHOLD ALL

June 4, 2018 - Part 4 of Voter Fraud Evidence

January 14, 2022

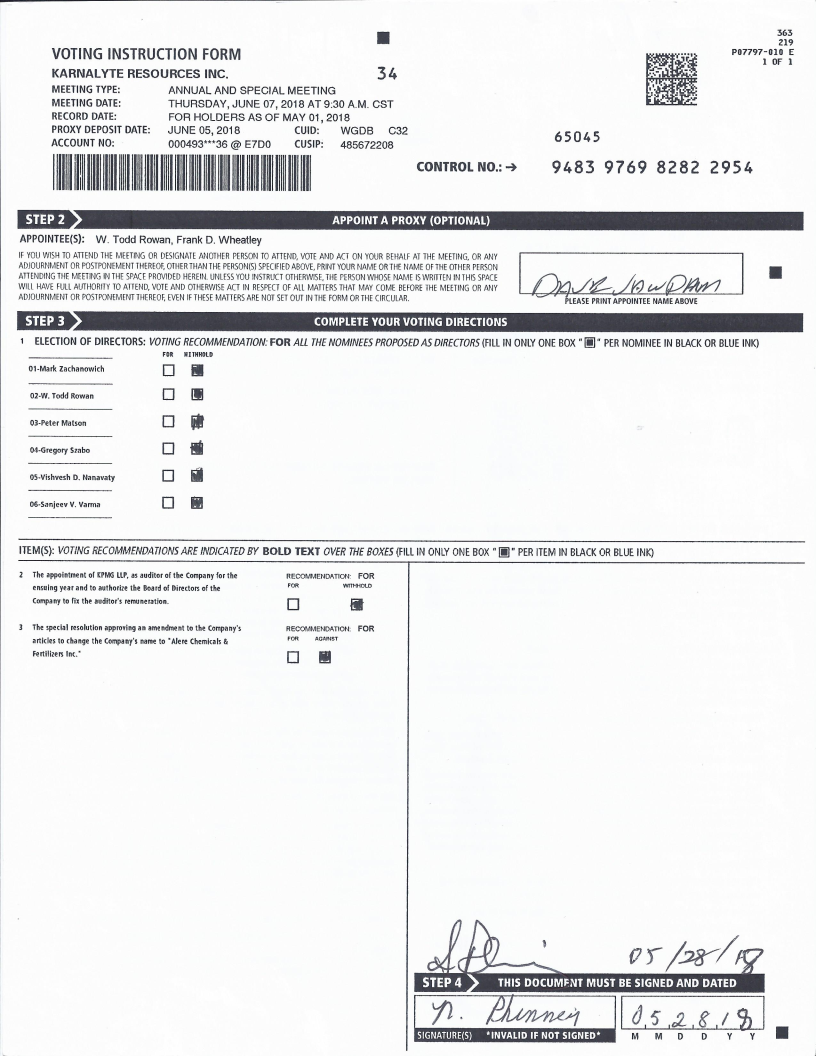

PROOF OF KARNALYTE 2018 VOTE FRAUD

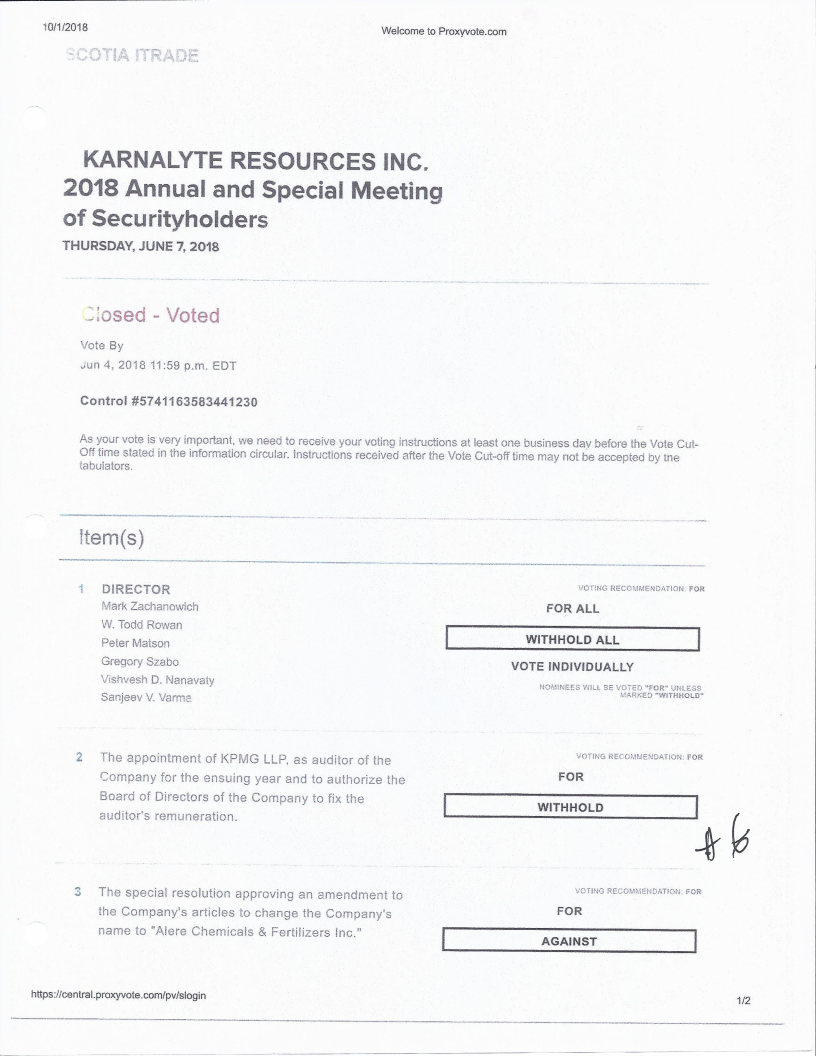

Following an inquiry to CIBC regarding changes to his personal votes cast at the 2018 KRN Annual Meeting, Stan Phinney received confirmation of multiple vote changes that KRN management orchestrated to win an “uncontested” vote for the entire Board of Directors. A WITHHOLD vote over 50% would have resulted in the entire board resigning.

EXHIBIT 4 of 40+: Attached Source: AST proxyvote.com

via Meera Dial, Senior Account Processing Officer, CIBC

Broker: CIBC Wood Gundy

Shareholder: Stan PHINNEY

Shareholder Vote Confirmation: June 4, 2018

Shares voted: 74,288

Votes Cast: WITHHOLD ALL

VOTE CHANGE: WITHOLD ALL to ABSTAINED (not counted)

AST Vote Record: Abstained Proxy: Management

Page 2

Attachment 1: Screenshot of file sent to Stan Phinney from Kathy Sundell CIBC, in response to his complaint about a second voter package sent out by AST/King using the same proxy numbers. This led to the discovery that AST could reopen the CLOSED vote files and alter the vote from WITHHOLD ALL to ABSTAIN.

Attachment 2: Email communication between Meera Dial, CIBC Toronto and Kathy Sundell, CIBC Wood Gundy, Thunder Bay.

Attachment 3:

Stan Phinney’s Control Numbers : 9483 9769 8282 2954

8347 7653 3906 6419

4983 0105 9391 0172

Attachment 4: Stan Phinney’s Vote Record with confirmation number

- Vote cast: WITHHOLD ALL

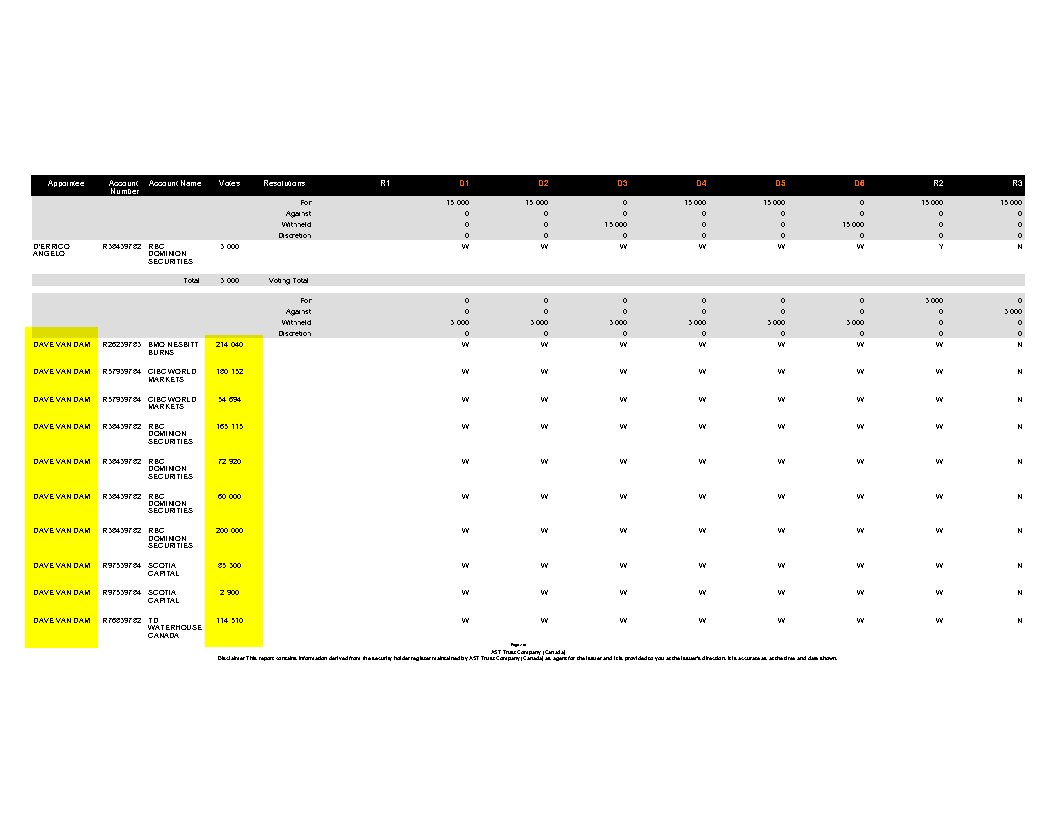

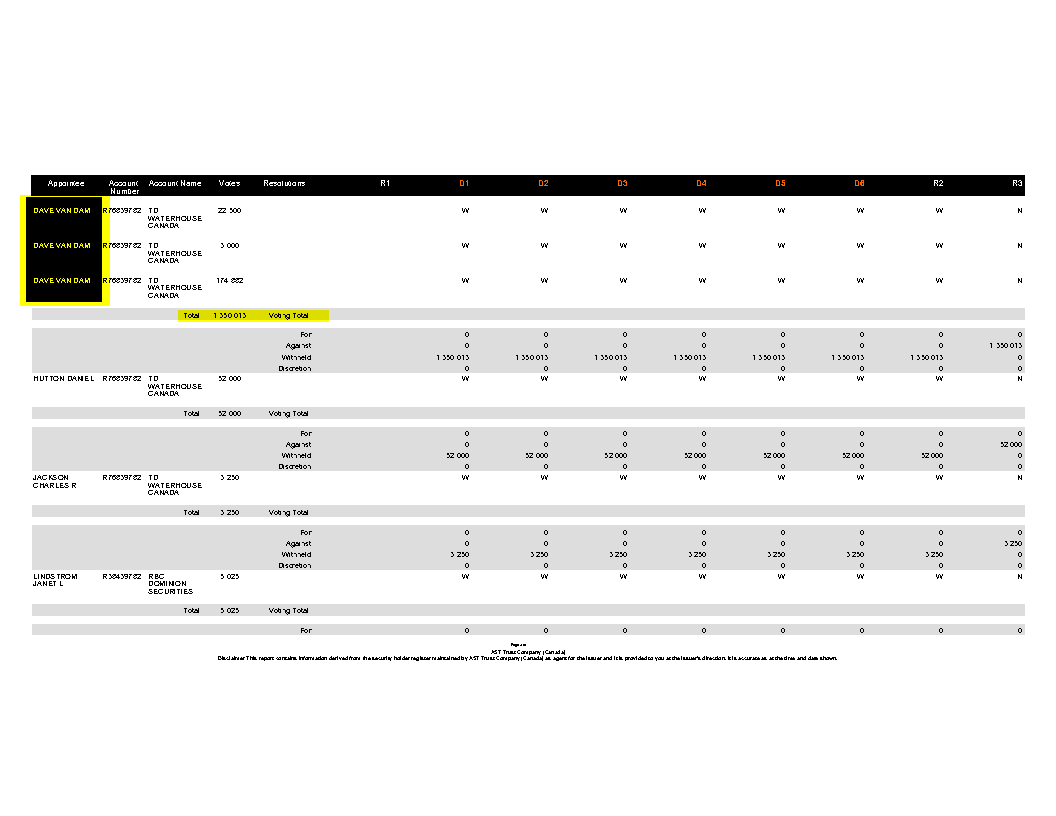

[EDIT : With Wheatly's Affidavit, Mr. Van Dam's 1,350,013 votes ALONE, Flip the voting to Karnalyte Losing the entire vote in the First scenario.

And in the 2nd scenario, only approx. 500,000 votes away from Karnalyte Completely losing.

Gee, I wonder if we can find an additional 500,000 votes to have Karnalyte completely lose in any formula?

Let us leave the Regulators to Answer that question????

Not really as they have done NOTHING about voter Fraud. We will provide more evidence.

| Today's Vote Totals the Karnalyte changed (abstained) | 1,350,013 | ||||

| Election of Directors | (2018 Results) | (From Sedar.com) | |||

| Name | Votes For | %Votes For | Votes Withheld | %Votes Withheld | |

| Mark Zachanowich | 9,697,555 | 55.31 | 7,837,010 | 44.69 | |

| W. Todd Rowan | 9,639,041 | 54.97 | 7,895,524 | 45.03 | |

| Peter Matson | 9,680,555 | 55.21 | 7,854,010 | 44.79 | |

| Gregory Szabo | 9,697,555 | 55.31 | 7,837,010 | 44.69 | |

| Vishvesh D. Nanavaty | 9,594,051 | 54.72 | 7,940,514 | 45.28 | |

| Sanjeev V. Varma | 9,579,051 | 54.63 | 7,955,514 | 45.37 | |

| Diff of votes | New votes removed | New Voted For % | New votes added | Today's Diff | New Votes Witheld NOW |

| -1,860,545 | 8,347,542 | 47.61% | 9,187,023 | 839,481 | 52.39% |

| -1,743,517 | 8,289,028 | 47.27% | 9,245,537 | 956,509 | 52.73% |

| -1,826,545 | 8,330,542 | 47.51% | 9,204,023 | 873,481 | 52.49% |

| -1,860,545 | 8,347,542 | 47.61% | 9,187,023 | 839,481 | 52.39% |

| -1,653,537 | 8,244,038 | 47.02% | 9,290,527 | 1,046,489 | 52.98% |

| -1,623,537 | 8,229,038 | 46.93% | 9,305,527 | 1,076,489 | 53.07% |

| And even to give the benefit of doubt Original KRN Values NOT Changed | |||||

| not removing votes Orginal Values | New Voted For % | New votes added | Today's Diff | New Votes Witheld NOW | |

| 9,697,555 | 51.35% | 9,187,023 | -510,532 | 48.65% | |

| 9,639,041 | 51.04% | 9,245,537 | -393,504 | 48.96% | |

| 9,680,555 | 51.26% | 9,204,023 | -476,532 | 48.74% | |

| 9,697,555 | 51.35% | 9,187,023 | -510,532 | 48.65% | |

| 9,594,051 | 50.80% | 9,290,527 | -303,524 | 49.20% | |

| 9,579,051 | 50.72% | 9,305,527 | -273,524 | 49.28% | |

[EDIT : The following is an Affidavit from Frank Wheatly filed with the Alberta Court of Queens Bench. The Full Affidavit is linked here This is 108 pages and 3MB in size.

We are highlighting the pages that are relevant to vote fraud (page 86-87). In Whealtly's own submission, Mr. Van Dam's votes were already submitted and recorded as "Withheld". So after this date, Karanlyte, including Wheatly who was part of the management of KRN, Change the legally binding vote of Mr. Van Dam. over 1.3 MILLION Share Recorded as WITHHELD - But Ultimately changed by Karnalyte to Abstain!!

Regulators - Is this not enough evidence of huge Voter Fraud?

Wait there s more for you to chew on!

[EDIT : We are now keeping a running total of the Shares needed to turn the from Karnalyte Voter Fraud of turning Shareholders votes to Abstain. As you can see with numbers it does not take a lot to change the outcome of the election. After only 3 hard pieces of evidence of 3 shareholders' vote changes, you can see the results. there are 37 more vote changes to come.]

| Today's Vote Totals the Karnalyte changed (abstained) | 573,539 | ||||

| Election of Directors | (2018 Results) | (From Sedar.com) | |||

| Name | Votes For | %Votes For | Votes Withheld | %Votes Withheld | |

| Mark Zachanowich | 9,697,555 | 55.31 | 7,837,010 | 44.69 | |

| W. Todd Rowan | 9,639,041 | 54.97 | 7,895,524 | 45.03 | |

| Peter Matson | 9,680,555 | 55.21 | 7,854,010 | 44.79 | |

| Gregory Szabo | 9,697,555 | 55.31 | 7,837,010 | 44.69 | |

| Vishvesh D. Nanavaty | 9,594,051 | 54.72 | 7,940,514 | 45.28 | |

| Sanjeev V. Varma | 9,579,051 | 54.63 | 7,955,514 | 45.37 | |

| Diff of votes | New votes removed | New Voted For % | New votes added | Today's Diff | New Votes Witheld NOW |

| -1,860,545 | 9,124,016 | 52.03% | 8,410,549 | -713,467 | 47.97% |

| -1,743,517 | 9,065,502 | 51.70% | 8,469,063 | -596,439 | 48.30% |

| -1,826,545 | 9,107,016 | 51.94% | 8,427,549 | -679,467 | 48.06% |

| -1,860,545 | 9,124,016 | 52.03% | 8,410,549 | -713,467 | 47.97% |

| -1,653,537 | 9,020,512 | 51.44% | 8,514,053 | -506,459 | 48.56% |

| -1,623,537 | 9,005,512 | 51.36% | 8,529,053 | -476,459 | 48.64% |

| And even to give the benefit of doubt Original KRN Values NOT Changed | |||||

| not removing votes Orginal Values | New Voted For % | New votes added | Today's Diff | New Votes Witheld NOW | |

| 9,697,555 | 53.55% | 8,410,549 | -1,287,006 | 46.45% | |

| 9,639,041 | 53.23% | 8,469,063 | -1,169,978 | 46.77% | |

| 9,680,555 | 53.46% | 8,427,549 | -1,253,006 | 46.54% | |

| 9,697,555 | 53.55% | 8,410,549 | -1,287,006 | 46.45% | |

| 9,594,051 | 52.98% | 8,514,053 | -1,079,998 | 47.02% | |

| 9,579,051 | 52.90% | 8,529,053 | -1,049,998 | 47.10% | |

[Edit - This section includes the running totals:

525,958 - Previous Post total

47,581 - this post

-----------

573,539 - Total Votes Changed to support KarnalytE against the vote by these shareholders (Stay Tuned, A Lot More to come!)

From: [email protected]

To: [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]

Sent: Tuesday, January 11, 2022 10:47 AM

Subject: Fwd: krn fraud

We the shareholders of Karnalyte want an answer

------ Original Message ------

From: [email protected]

To: [email protected]

Sent: Tuesday, January 11, 2022 10:43 AM

Subject: krn fraud

https://stockhouse.com/companies/bullboard/t.krn/karnalyte-resources-inc?postid=34302093

Looks like krnshareholders.com have had enough!

http://localhost:63342/

I am absolutely stunned at the number of regulator contacts that

have been advised of concerns regarding DF Kings involvement in the

Karnalyte 2018 election results, and yet it appears there has been

very little satisfaction for those shareholders to date.

What is it going to take for agencies designed to protect Canada's

shareholders to get the lead out of their back pockets, and start

protecting these shareholders?

Would it not be considered a huge conflict of interest if DF King

was hired to provide the following services a week or so before an

AGM, but also hired as the corporations Tabulation Agent to oversee

the final votes?

"“The Company has engaged the services of D.F. King, a division of

AST Investor Services Inc. (Canada), as its proxy solicitation and

information agent. Engaging a proxy solicitor is very common for

publicly traded – companies as it helps facilitate shareholder

engagement in the governance of the company. Initiating a targeted

shareholder engagement effort supports shareholder democracy by

ensuring that all shareholders, despite the size of their holdings,

receive timely, current, and comprehensive information about the

Company and the matters to be voted on at its shareholder

meetings. D.F. King has been engaged at an anticipated cost of $125,000 consisting of a base fee of $50,000 and an additional fee of $35,000, if management's nominees are elected and

each of the resolutions recommended by management is

passed, and a further $40,000, based on the number of votes cast in favour of, or withheld from voting for, each of management's nominees. The

total potential cost will be borne by the Company"

So how in the world could DF King be hired as Tabulation Agent

considering DF King would have direct access to every shareholders

proxy control number?

Even more of a kick in the teeth to shareholders, DF King got paid 6

figures for their services!

There appears to be a real fundamental system flaw in a Canadian

corporations shareholders democratic right to vote, if those votes

can be changed at the whim of a Transfer Agent hired to ensure

victory of incumbent directors.

Even worse, a couple years later the TMX Group acquires AST and in

doing so, also DF King when the TMX had already been advised of

fraud concerns, according to the folks at

krnshareholders.com.

https://www.tmx.com/newsroom/press-releases?id=973

https://www.tsx.com/contact/other-inquiries

Unbelievable!

From: [email protected]

To: [email protected]

Cc: [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]

Sent: Monday, January 10, 2022 1:16 PM

Subject: krn fraud and securities breaches

To whom it may concern:

This is my third contact to you showing the votes at Karnalyte AGM were changed. We are posting the details on www.krnshareholders.com.

Your site tells us how honesty and integrity are how you build your business.

YOUR SYSTEM WAS BREACHED BY AST / D. F. King and no one seems to give a damn.

I suggest you follow our website closely as the info will shock everyone. I suggest your legal people read ALL very closely. The truth is coming out.

The shareholders of Karnalyte deserve an answer.

Yours Truly

Stan Phinney

Shareholders of Karnalyte Resources

[Edit - This section includes the running totals:

50,000 - From Previous Posting

185,621 - Previous Post total

290,337 - this post

-----------

525,958 - Total Votes Changed to support KarnalytE against the vote by these shareholders (Stay Tuned, A Lot More to come!)

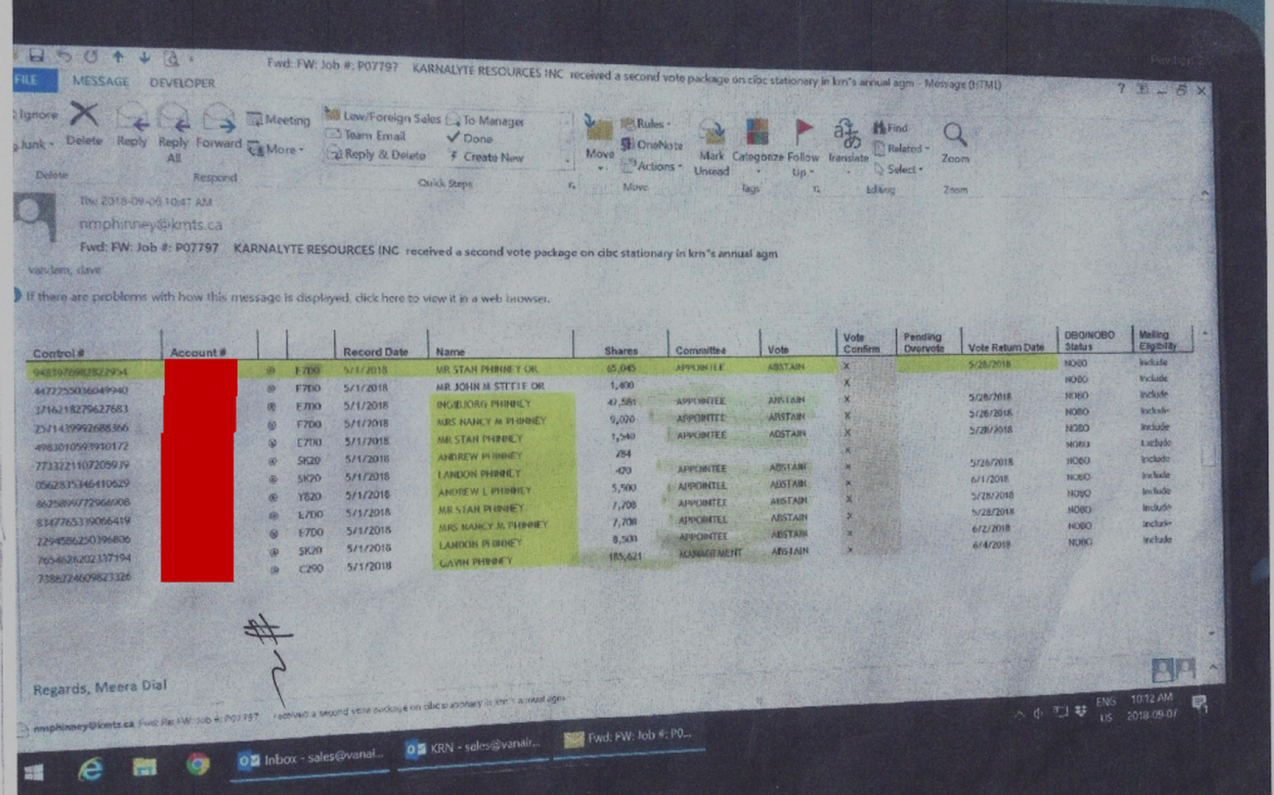

[EDIT : This information below has not been modified except for the Account numbers of the individuals who have been blacked out (actuallyly red ) The "vote" column have all words of "Abstain" 90% of these have a last name of "Phinney" and would never have abstained!

As the votes do not need much to tip the balance of the vote, We will be keeping a running total of the votes not counted.

This batch has a total votes not counted of 185,621

Total : 185,621 so far]

[EDIT: The following 4 affidavits from the previous management of Karnalyte are very telling. These four individuals are personally responsible for the decision, of what we believe is voter fraud, in 2018. But here they are 1 year later "complaining" about GSFC that they are bad actors ( very similar to "The Pot calling the Kettle Black")

As they all were involved in the decision in what we believe 2018 voter fraud, they all have conveniently left out what they did in 2018 and ONLY focused on events AFTER 2018, in 2019-2020, when GSFC "Screwed them".]

[EDIT : Peter Mason affidavits states that one of the issues with GSFC